Question: 6. Using the same numerical values as in the 2-period binomial model in Example 2 a. Calculate today's price, P0, of a 6-month European put

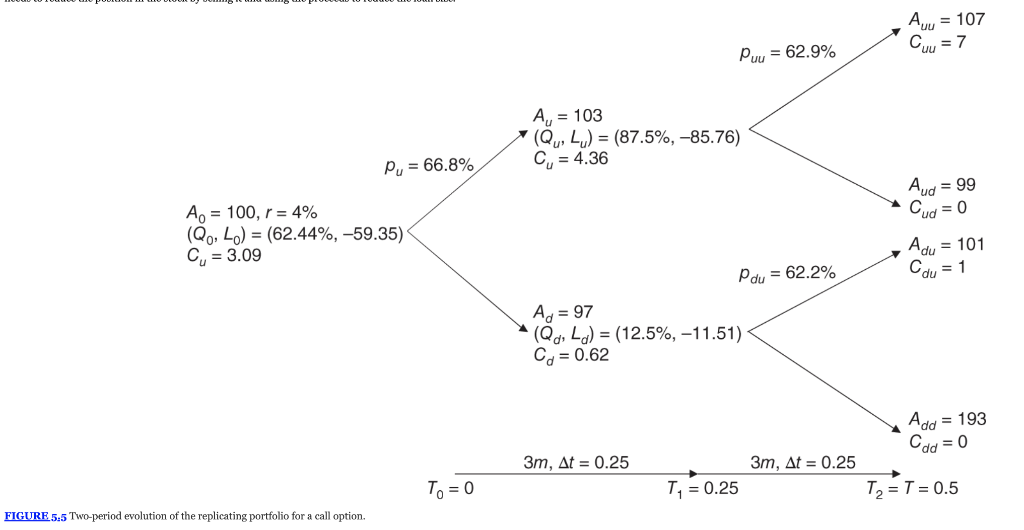

6. Using the same numerical values as in the 2-period binomial model in Example 2 a. Calculate today's price, P0, of a 6-month European put option with strike K=$100. b. Calculate today's value of a 6-month forward contract with purchase price K=$100. c. Verify that C0P0=VFA(0,T,K). FIGURE 5:5 Two-period er

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts