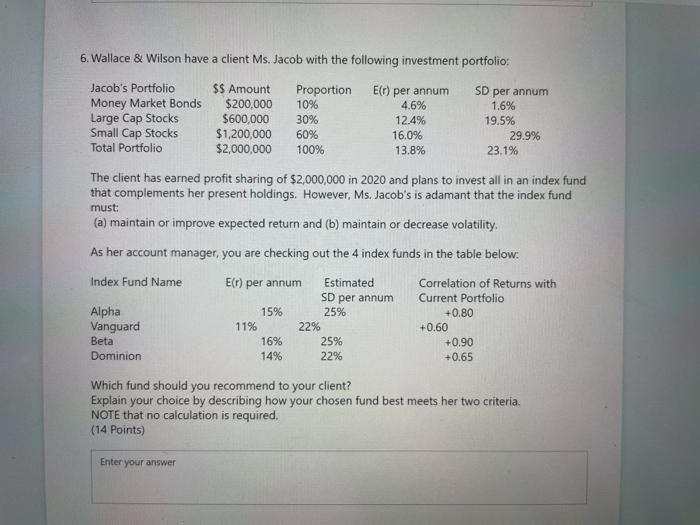

Question: 6. Wallace & Wilson have a client Ms. Jacob with the following investment portfolio: Jacob's Portfolio Money Market Bonds Large Cap Stocks Small Cap Stocks

6. Wallace & Wilson have a client Ms. Jacob with the following investment portfolio: Jacob's Portfolio Money Market Bonds Large Cap Stocks Small Cap Stocks Total Portfolio $S Amount $200,000 $600,000 $1,200,000 $2,000,000 Proportion 10% 30% 60% 100% El) per annum 4.6% 12.4% 16.0% 13.8% SD per annum 1.6% 19.5% 29.9% 23.1% The client has earned profit sharing of $2,000,000 in 2020 and plans to invest all in an index fund that complements her present holdings. However, Ms. Jacob's is adamant that the index fund must: (a) maintain or improve expected return and (b) maintain or decrease volatility. As her account manager, you are checking out the 4 index funds in the table below: Index Fund Name E(!) per annum Estimated Correlation of Returns with SD per annum Current Portfolio Alpha 15% 25% +0.80 Vanguard 11% 22% +0.60 Beta 16% 25% +0.90 Dominion 14% 22% +0.65 Which fund should you recommend to your client? Explain your choice by describing how your chosen fund best meets her two criteria. NOTE that no calculation is required. (14 points) Enter your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts