Question: 6. What are the two primary drawbacks to the payback period method? a. Difficult to calculate; ignores time value of money b. Difficult to calculate;

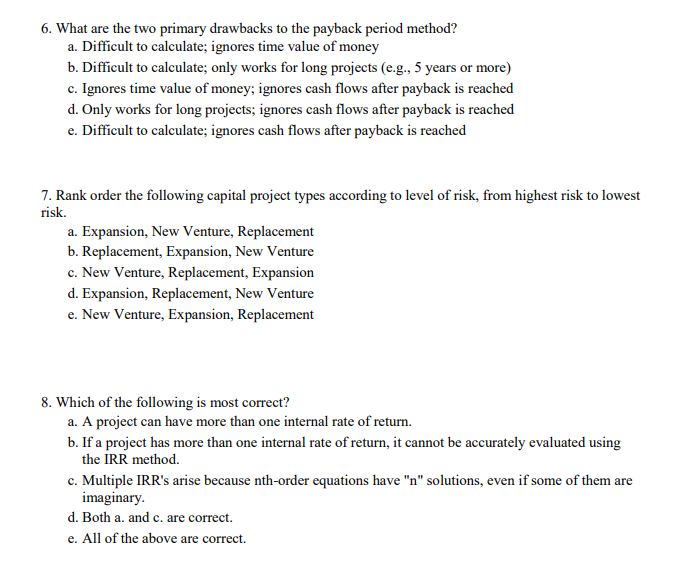

6. What are the two primary drawbacks to the payback period method? a. Difficult to calculate; ignores time value of money b. Difficult to calculate; only works for long projects (e.g., 5 years or more) c. Ignores time valu d. Only works for long projects; ignores cash flows after payback is reached e. Difficult to calculate; ignores cash flows after payback is reached e of money; ignores cash flows after payback is reached 7. Rank order the following capital project types according to level of risk, from highest risk to lowest risk a. Expansion, New Venture, Replacement b. Replacement, Expansion, New Venture c. New Venture, Replacement, Expansion d. Expansion, Replacement, New Venture e. New Venture, Expansion, Replacement 8. Which of the following is most correct? a. A project can have more than one internal rate of return. b. If a project has more than one internal rate of return, it cannot be accurately evaluated using the IRR method. c. Multiple IRR's arise because nth-order equations have "n" solutions, even if some of them are imaginary d. Both a. and c. are correct. e. All of the above are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts