Question: 6) What is the expected market return if the expected return on asset A is 19% and the risk free rate is 5% ? Asset

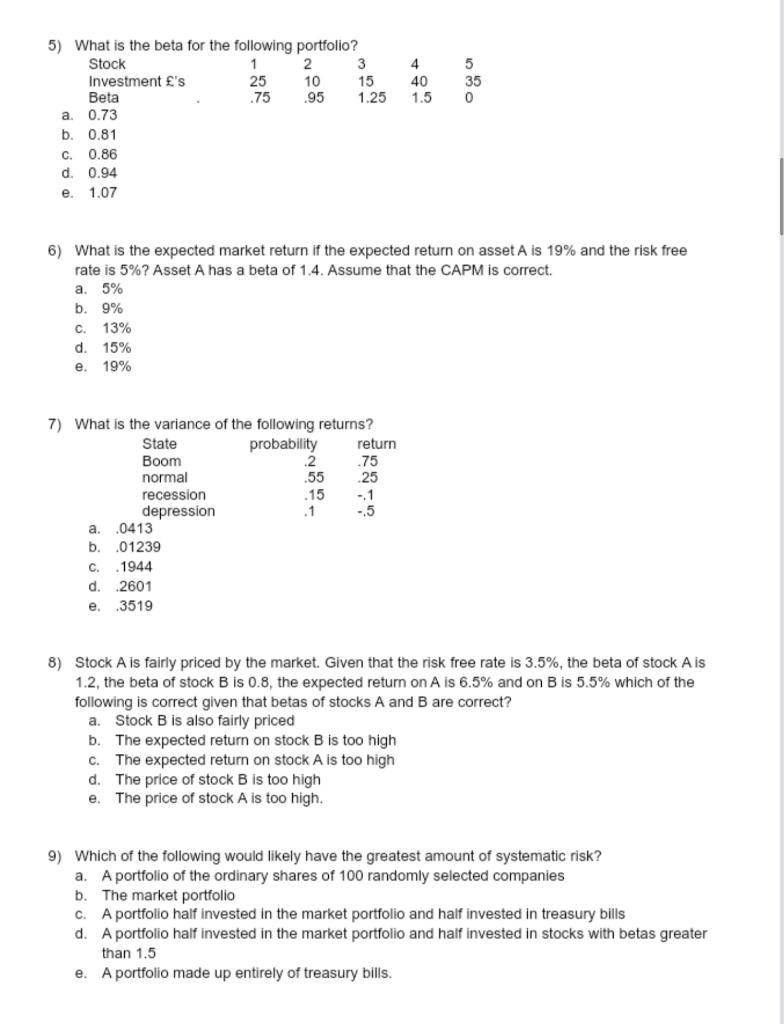

6) What is the expected market return if the expected return on asset A is 19% and the risk free rate is 5% ? Asset A has a beta of 1.4. Assume that the CAPM is correct. a. 5% b. 9% c. 13% d. 15% e. 19% 7) What is the variance of the following returns? StateBoomnormalrecessiondepressionprobability.2.55.15.1return.75.25.1.5 a. .0413 b. 01239 c. .1944 d. 2601 e. 3519 8) Stock A is fairly priced by the market. Given that the risk free rate is 3.5%, the beta of stock A is 1.2, the beta of stock B is 0.8, the expected return on A is 6.5% and on B is 5.5% which of the following is correct given that betas of stocks A and B are correct? a. Stock B is also fairly priced b. The expected return on stock B is too high c. The expected return on stock A is too high d. The price of stock B is too high e. The price of stock A is too high. 9) Which of the following would likely have the greatest amount of systematic risk? a. A portfolio of the ordinary shares of 100 randomly selected companies b. The market portfolio c. A portfolio half invested in the market portfolio and half invested in treasury bills d. A portfolio half invested in the market portfolio and half invested in stocks with betas greater than 1.5 e. A portfolio made up entirely of treasury bills

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts