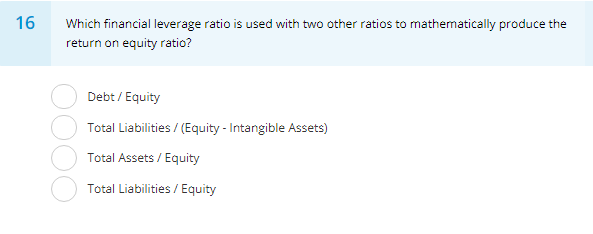

Question: 6 Which financial leverage ratio is used with two other ratios to mathematically produce the return on equity ratio? Debt/ Equity Total Liabilities/(Equity - Intangible

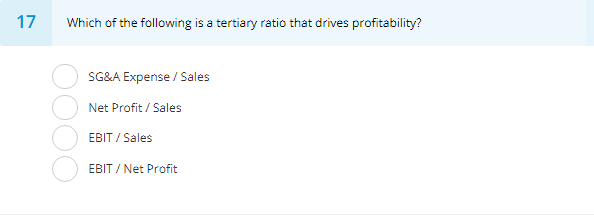

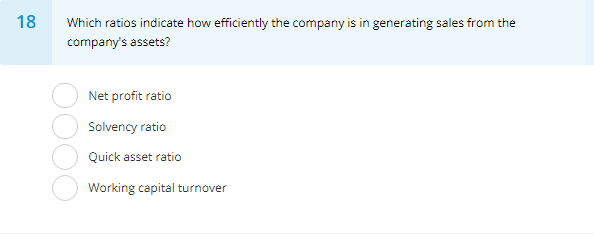

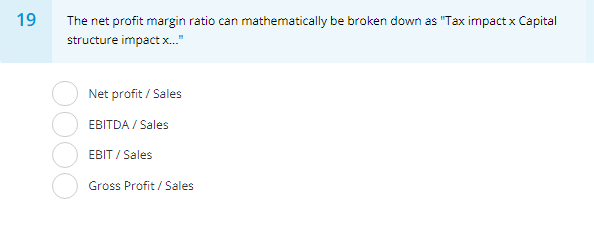

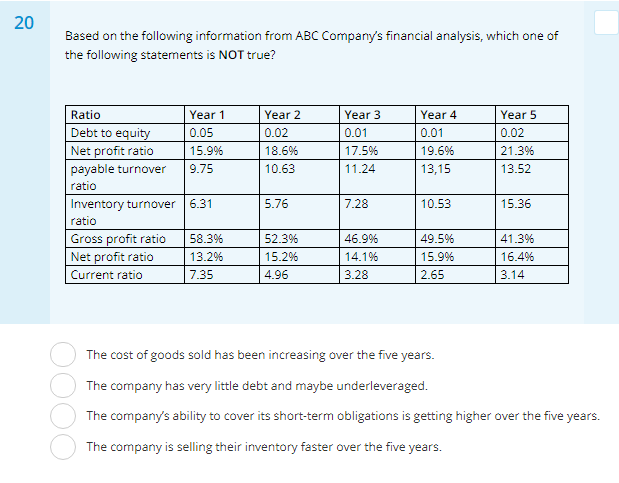

6 Which financial leverage ratio is used with two other ratios to mathematically produce the return on equity ratio? Debt/ Equity Total Liabilities/(Equity - Intangible Assets) Total Assets/ Equity Total Liabilities/Equity 17 Which of the following is a tertiary ratio that drives profitability? SG&A Expense/Sales Net Profit/Sales EBIT /Sales EBIT /Net Profit 18 Which ratios indicate how efficiently the company is in generating sales from the company's assets? Net profit ratio Solvency ratio Quick asset ratio Working capital turnover 19 The net profit margin ratio can mathematically be broken down as "Tax impact x Capital structure impactx... Net profit Sales EBITDA/Sales EBIT /Sales Gross Profit/ Sales 20 Based on the following information from ABC Company's financial analysis, which one of the following statements is NOT true? Ratio Debt to equi Net profit ratio payable turnover 9.75 ratio Inventory turnover 6.31 ratio Gross profit ratio 58.3% Net profit ratio Current ratio Year 2 0.02 18.6% 10.63 Year 3 0.01 17.5% 11.24 Year 5 0.02 21.3% 13.52 Year 1 0.05 15.996 Year 4 0.01 19.6% 13,15 10.53 5.76 7.28 15.36 41.3% 16.4% 3.14 52.3% 15.2% 4.96 46.9% 14.1% 3.28 49.5% 15.9% 2.65 13.2% 7.35 The cost of goods sold has been increasing over the five years. The company has very little debt and maybe underleveraged The company's ability to cover its short-term obligations is getting higher over the five years. The company is selling their inventory faster over the five years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts