Question: 6. Which of the following changes in inventory method would not require prior period adjustments (retrospectively changing previous years' financial statements)? A change LIFO to

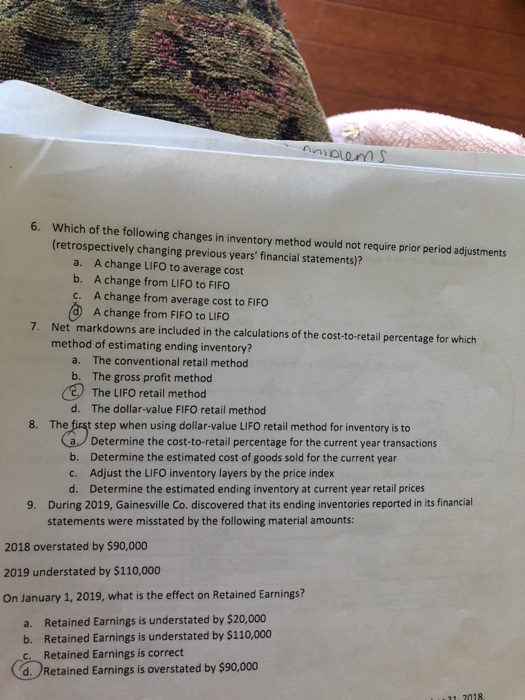

6. Which of the following changes in inventory method would not require prior period adjustments (retrospectively changing previous years' financial statements)? A change LIFO to average cost b. A change from LIFO to FIFO A change from average cost to FIFO A change from FIFO to LIFO a. C. 7. Net markdowns are included in the calculations of the cost-to-retail percentage for which method of estimating ending inventory? The conventional retail method a. b. The gross profit method eThe LIFO retail method The dollar-value FIFO retail method d. The first step when using dollar-value LIFO retail method for inventory is to Determine the cost-to-retail percentage for the current year transactions b. Determine the estimated cost of goods sold for the current year 8. a Adjust the LIFO inventory layers by the price index Determine the estimated ending inventory at current year retail prices c. d. During 2019, Gainesville Co. discovered that its ending inventories reported in its financial statements were misstated by the following material amounts: 9. 2018 overstated by $90,000 2019 understated by $110,000 On January 1, 2019, what is the effect on Retained Earnings? a. Retained Earnings is understated by $20,000 b. Retained Earnings is understated by $110,000 Retained Earnings is correct C d. Retained Earnings is overstated by $90,000 31 2018 6. Which of the following changes in inventory method would not require prior period adjustments (retrospectively changing previous years' financial statements)? A change LIFO to average cost b. A change from LIFO to FIFO A change from average cost to FIFO A change from FIFO to LIFO a. C. 7. Net markdowns are included in the calculations of the cost-to-retail percentage for which method of estimating ending inventory? The conventional retail method a. b. The gross profit method eThe LIFO retail method The dollar-value FIFO retail method d. The first step when using dollar-value LIFO retail method for inventory is to Determine the cost-to-retail percentage for the current year transactions b. Determine the estimated cost of goods sold for the current year 8. a Adjust the LIFO inventory layers by the price index Determine the estimated ending inventory at current year retail prices c. d. During 2019, Gainesville Co. discovered that its ending inventories reported in its financial statements were misstated by the following material amounts: 9. 2018 overstated by $90,000 2019 understated by $110,000 On January 1, 2019, what is the effect on Retained Earnings? a. Retained Earnings is understated by $20,000 b. Retained Earnings is understated by $110,000 Retained Earnings is correct C d. Retained Earnings is overstated by $90,000 31 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts