Question: 6) You are comidering two bonds. Bond A has . 9% annual coupon while Bond B ha ,6% coupon. Both bonds have a 7% yield

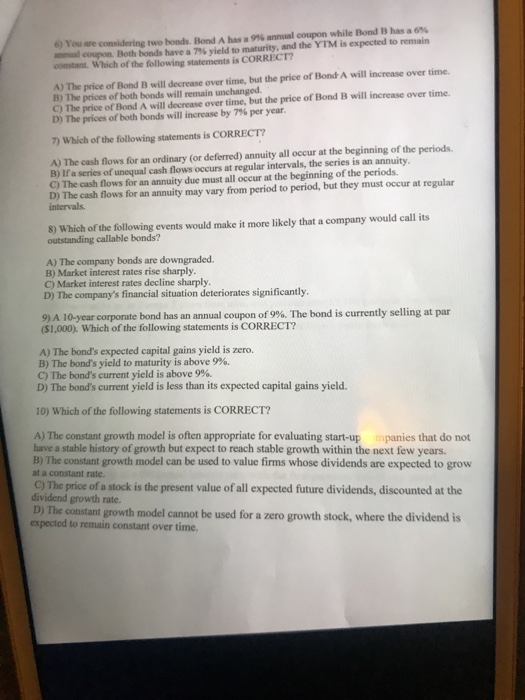

6) You are comidering two bonds. Bond A has . 9% annual coupon while Bond B ha ,6% coupon. Both bonds have a 7% yield to maturity, and the YTM is expected to remain constant. Which of the following statements is CORRECT? A) The price of Bond B will decrease over time, but the price of Bond A will increase over time. B) The prices of both bonds will remain unchanged. C) The price of Bond A will decrease over time, but the price of Bond B will increase over time. D)The prices ofboth bonds will increase by 7% per year. 7) Which of the following statements is CORRECT? A) The cash flows for an ordinary (or deferred) annuity all occur at the beginning of the periods. B) If a series of unequal cash flows occurs at regular intervals, the series is an annuity C) The cash flows for an annuity due must all occur at the beginning of the periods. D) The cash fnows for an annuity may vary from period to period, but they must occur at regular intervals 8) Which of the following events would make it more likely that a company would call its outstanding callable bonds? A) The company bonds are downgraded B) Market interest rates rise sharply C) Market interest rates decline sharply D) The company's financial situation deteriorates significantly 9) A 10-year corporate bond has an annual coupon of99 . The bond is currently selling at par ($1,000). Which of the following statements is CORRECT? A) The bond's expected capital gains yield is zero. B) The bond's yield to maturity is above 9%. C) The bond's current yield is above 9%. D) The bond's current yield is less than its expected capital gains yield. 10) Which of the following statements is CORRECT? A) The constant growth model is often appropriate for evaluating start-up mpanies that do not have a stable history of growth but expect to reach stable growth within the next few years. B) The constant growth model can be used to value firms whose dividends are expected to grow at a constant rate. C) The price of a stock is the present value of all expected future dividends, discounted at the dividend growth rate. D) The constant growth model cannot be used for a zero growth stock, where the dividend is expected to remain constant over time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts