Question: 6. You are taking out a fully amortizing loan for $300,00 over 30 years. You can choose between a loan at 8.5% with 3 points

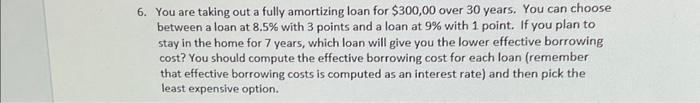

6. You are taking out a fully amortizing loan for $300,00 over 30 years. You can choose between a loan at 8.5% with 3 points and a loan at 9% with 1 point. If you plan to stay in the home for 7 years, which loan will give you the lower effective borrowing cost? You should compute the effective borrowing cost for each loan (remember that effective borrowing costs is computed as an interest rate) and then pick the least expensive option.

6. You are taking out a fully amortizing loan for $300,00 over 30 years. You can choose between a loan at 8.5% with 3 points and a loan at 9% with 1 point. If you plan to stay in the home for 7 years, which loan will give you the lower effective borrowing cost? You should compute the effective borrowing cost for each loan (remember that effective borrowing costs is computed as an interest rate) and then pick the least expensive option

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock