Question: 6. You have two proposals to choose between. The initial proposal (H) has a cash flow that is different than the revised proposal (1). Assume

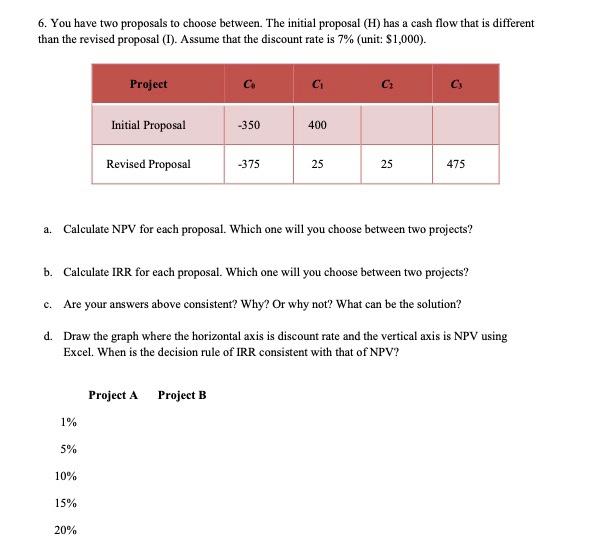

6. You have two proposals to choose between. The initial proposal (H) has a cash flow that is different than the revised proposal (1). Assume that the discount rate is 7% (unit: $1,000). Project Initial Proposal -350 400 Revised Proposal -375 25 25 475 a. Calculate NPV for each proposal. Which one will you choose between two projects? b. Calculate IRR for each proposal. Which one will you choose between two projects? c. Are your answers above consistent? Why? Or why not? What can be the solution? d. Draw the graph where the horizontal axis is discount rate and the vertical axis is NPV using Excel. When is the decision rule of IRR consistent with that of NPV? Project A Project B 1% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 75% 80% 85% 90% 95% 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts