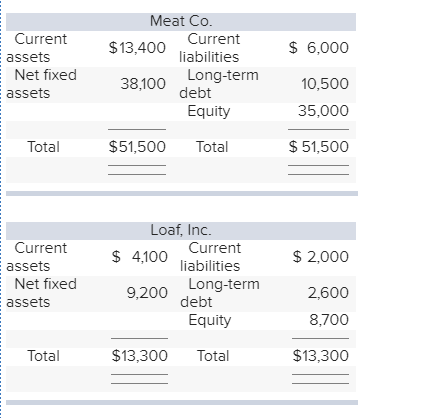

Question: $ 6,000 Current assets Net fixed assets Meat Co. Current $13,400 liabilities Long-term 38,100 debt Equity 10,500 35,000 Total $51,500 Total $ 51,500 $ 2,000

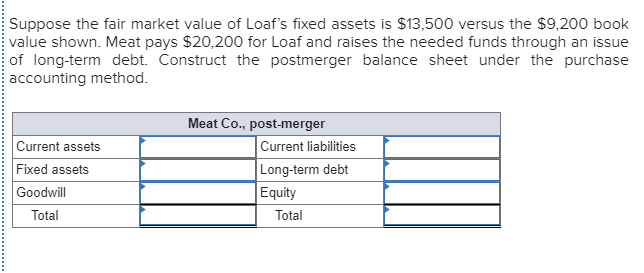

$ 6,000 Current assets Net fixed assets Meat Co. Current $13,400 liabilities Long-term 38,100 debt Equity 10,500 35,000 Total $51,500 Total $ 51,500 $ 2,000 Current assets Net fixed assets Loaf, Inc. Current $ 4,100 liabilities 9,200 Long-term debt Equity 2,600 8,700 Total $13,300 Total $13,300 Suppose the fair market value of Loaf's fixed assets is $13,500 versus the $9,200 book value shown. Meat pays $20,200 for Loaf and raises the needed funds through an issue of long-term debt Construct the postmerger balance sheet under the purchase accounting method. Current assets Fixed assets Goodwill Total Meat Co., post-merger Current liabilities Long-term debt Equity Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts