Question: 61 Normal Strong Subtitle Title Aalbcd dabce 403bcc albe Light bree. Sutinem. ACC12301 Taxation - Assament 2 2020 Se N201 - Ain C10 Cla 45

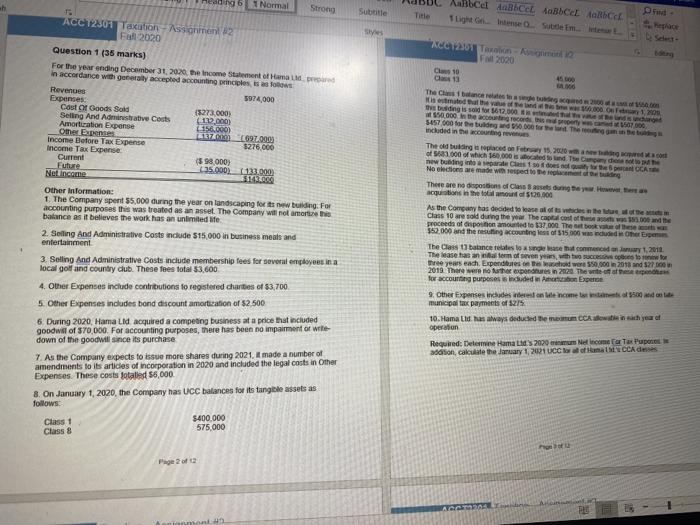

61 Normal Strong Subtitle Title Aalbcd dabce 403bcc albe Light bree. Sutinem. ACC12301 Taxation - Assament 2 2020 Se N201 - Ain C10 Cla 45 000 Question 1 (35 marks) For the year anding December 31, 2000, the income Statement of a in accordance with generally accepted accounting principles is so Revenues 5974,000 Expenses Cast of Goods Sold 3273.000) Selling And Administrative Costs 132,000) Amortization Expense 156.000) Other Expenses ZOO 697.000 Income Before Tax Expense $276.000 Income Tax Expense Current (598.000) Future 35.000) 133.000 Not income $113 mated that the thing is sold for $2.000 50.000 the action 5457 000 for the building door 200 Other Information: 1. The Company spent 55,000 during the year on landscaping for new building For accounting purposes this was treated as an asset. The company will not more the balance as it believes the work has an unlimited life 2. Selling And Administrative Costs include 515,000 in business meals and entertainment 3. Selling And Administrative Costs include membership fees for several employees in a local golf and country club. These fees total 53.600 4. Other Expenses include contributions to registered chutes of $3,700 5. Other Expenses includes bond discount amortization of $2.500 6. During 2020, Hama Lid acquired a competing business at a price that included goodwill of $70,000. For accounting purposes, there has been no impairment of write down of the goodwill since its purchase 7. As the Company expects to issue more shares during 2021, made a number of amendments to its articles of Incorporation in 2020 and included the legal costs in Other Expenses. These costs Jotalled 56,000 8. On January 1, 2020, the Company has UCC balances for its tangible assets as follows: Class 1 $400.000 Class 8 575,000 Theo bulding placed on Feb 15.00 of 1000 of which 10.000 de new Bing into a las dos CA No elections we made wespedo Desting There are no dispositions of Classes during they were acuations in the total amount of $125.000 As the Company has decided to se des the Class 10 are sold during the year. The capital cost of the 100 the proceeds of position amounted to $37.000 The book of these 552.000 and the testing accounting less of $15.00 was included wonerse The Class balance relates to the commonwy 1, 2011 These has an alle of years, with opens to be hree years each. Expends on 50,000 in 2015 and 21.00 2019 There were the expenditure in 2020 The writer of for accounting purposes inden Experte 9. Other Expenses includes were on the income teste 500 do municipal tax payments of 27% 10. Hama tid has always deducted the man weinth year of operation Required: Determine Hamad 2020 Nencome Tax Pune addition, calculate the January 1, 2021 UCC CCA 61 Normal Strong Subtitle Title Aalbcd dabce 403bcc albe Light bree. Sutinem. ACC12301 Taxation - Assament 2 2020 Se N201 - Ain C10 Cla 45 000 Question 1 (35 marks) For the year anding December 31, 2000, the income Statement of a in accordance with generally accepted accounting principles is so Revenues 5974,000 Expenses Cast of Goods Sold 3273.000) Selling And Administrative Costs 132,000) Amortization Expense 156.000) Other Expenses ZOO 697.000 Income Before Tax Expense $276.000 Income Tax Expense Current (598.000) Future 35.000) 133.000 Not income $113 mated that the thing is sold for $2.000 50.000 the action 5457 000 for the building door 200 Other Information: 1. The Company spent 55,000 during the year on landscaping for new building For accounting purposes this was treated as an asset. The company will not more the balance as it believes the work has an unlimited life 2. Selling And Administrative Costs include 515,000 in business meals and entertainment 3. Selling And Administrative Costs include membership fees for several employees in a local golf and country club. These fees total 53.600 4. Other Expenses include contributions to registered chutes of $3,700 5. Other Expenses includes bond discount amortization of $2.500 6. During 2020, Hama Lid acquired a competing business at a price that included goodwill of $70,000. For accounting purposes, there has been no impairment of write down of the goodwill since its purchase 7. As the Company expects to issue more shares during 2021, made a number of amendments to its articles of Incorporation in 2020 and included the legal costs in Other Expenses. These costs Jotalled 56,000 8. On January 1, 2020, the Company has UCC balances for its tangible assets as follows: Class 1 $400.000 Class 8 575,000 Theo bulding placed on Feb 15.00 of 1000 of which 10.000 de new Bing into a las dos CA No elections we made wespedo Desting There are no dispositions of Classes during they were acuations in the total amount of $125.000 As the Company has decided to se des the Class 10 are sold during the year. The capital cost of the 100 the proceeds of position amounted to $37.000 The book of these 552.000 and the testing accounting less of $15.00 was included wonerse The Class balance relates to the commonwy 1, 2011 These has an alle of years, with opens to be hree years each. Expends on 50,000 in 2015 and 21.00 2019 There were the expenditure in 2020 The writer of for accounting purposes inden Experte 9. Other Expenses includes were on the income teste 500 do municipal tax payments of 27% 10. Hama tid has always deducted the man weinth year of operation Required: Determine Hamad 2020 Nencome Tax Pune addition, calculate the January 1, 2021 UCC CCA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts