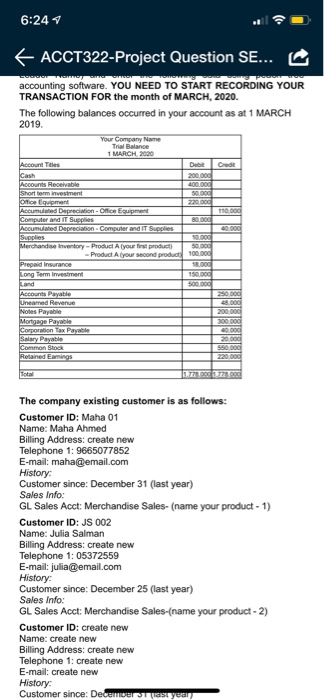

Question: 6:24 1 + ACCT322-Project Question SE... accounting software. YOU NEED TO START RECORDING YOUR TRANSACTION FOR the month of MARCH, 2020. The following balances occurred

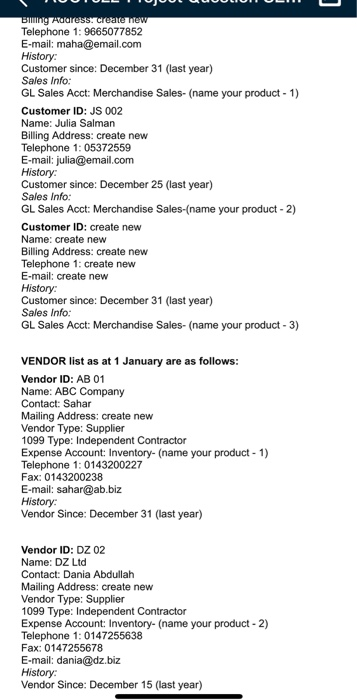

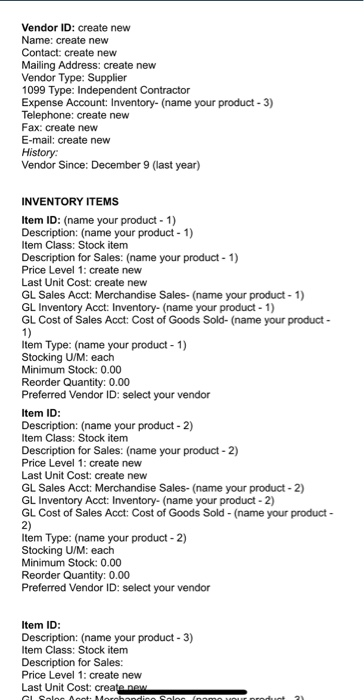

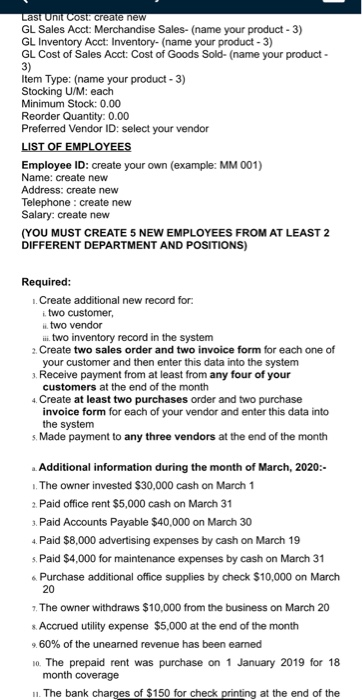

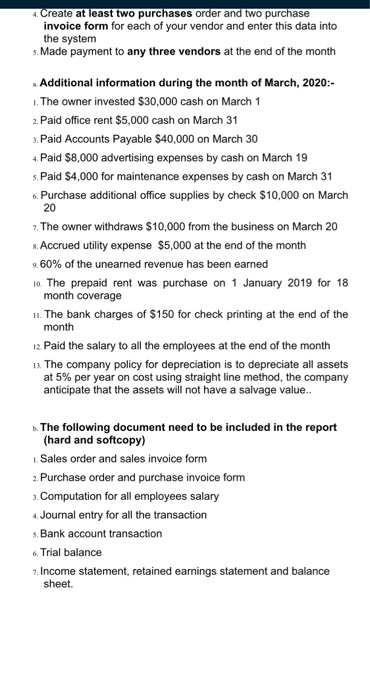

6:24 1 + ACCT322-Project Question SE... accounting software. YOU NEED TO START RECORDING YOUR TRANSACTION FOR the month of MARCH, 2020. The following balances occurred in your account as at 1 MARCH 2019. The company existing customer is as follows: Customer ID: Maha 01 Name: Maha Ahmed Billing Address: create new Telephone 1: 9665077852 E-mail: maha@email.com History Customer since: December 31 (last year) Sales Info: GL Sales Acct: Merchandise Sales-(name your product - 1) Customer ID: JS 002 Name: Julia Salman Billing Address: create new Telephone 1: 05372559 E-mail: julia@email.com History: Customer since: December 25 (last year) Sales Info: GL Sales Acct: Merchandise Sales-(name your product - 2) Customer ID: create new Name: create new Billing Address: create new Telephone 1: create new E-mail: create new History Customer since: December i st year SOOS OOOOO Billing Address create new Telephone 1: 9665077852 E-mail: maha@email.com History: Customer since: December 31 (last year) Sales Info: GL Sales Acct: Merchandise Sales-(name your product - 1) Customer ID: JS 002 Name: Julia Salman Billing Address: create new Telephone 1: 05372559 E-mail: julia@email.com History Customer since: December 25 (last year) Sales Info: GL Sales Acct: Merchandise Sales-(name your product - 2) Customer ID: create new Name: create new Billing Address: create new Telephone 1: create new E-mail: create new History: Customer since: December 31 (last year) Sales Info: GL Sales Acct: Merchandise Sales-(name your product - 3) VENDOR list as at 1 January are as follows: Vendor ID: AB 01 Name: ABC Company Contact: Sahar Mailing Address: create new Vendor Type: Supplier 1099 Type: Independent Contractor Expense Account: Inventory- (name your product - 1) Telephone 1: 0143200227 Fax: 0143200238 E-mail: sahar@ab.biz History: Vendor Since: December 31 (last year) Vendor ID: DZ 02 Name: DZ Ltd Contact: Dania Abdullah Mailing Address: create new Vendor Type: Supplier 1099 Type: Independent Contractor Expense Account: Inventory- (name your product - 2) Telephone 1: 0147255638 Fax: 0147255678 E-mail: dania@dz.biz History: Vendor Since: December 15 (last year) Vendor ID: create new Name: create new Contact: create new Mailing Address: create new Vendor Type: Supplier 1099 Type: Independent Contractor Expense Account: Inventory- (name your product - 3) Telephone: create new Fax: create new E-mail: create new History: Vendor Since: December 9 (last year) INVENTORY ITEMS Item ID: (name your product - 1) Description: (name your product - 1) Item Class: Stock item Description for Sales: (name your product - 1) Price Level 1: create new Last Unit Cost: create new GL Sales Acct: Merchandise Sales-(name your product - 1) GL Inventory Acct: Inventory- (name your product - 1) GL Cost of Sales Acct: Cost of Goods Sold-(name your product Item Type: (name your product - 1) Stocking U/M: each Minimum Stock: 0.00 Reorder Quantity: 0.00 Preferred Vendor ID: select your vendor Item ID: Description: (name your product - 2) Item Class: Stock item Description for Sales: (name your product-2) Price Level 1: create new Last Unit Cost: create new GL Sales Acct: Merchandise Sales-(name your product - 2) GL Inventory Acct: Inventory- (name your product - 2) GL Cost of Sales Acct: Cost of Goods Sold - (name your product- Item Type: (name your product - 2) Stocking U/M: each Minimum Stock: 0.00 Reorder Quantity: 0.00 Preferred Vendor ID: select your vendor Item ID: Description: (name your product - 3) Item Class: Stock item Description for Sales: Price Level 1: create new Last Unit Cost: create new Last Unit Cost: create new GL Sales Acct: Merchandise Sales- (name your product - 3) GL Inventory Acct: Inventory- (name your product - 3) GL Cost of Sales Acct: Cost of Goods Sold-(name your product- 3) Item Type: (name your product - 3) Stocking U/M: each Minimum Stock: 0.00 Reorder Quantity: 0.00 Preferred Vendor ID: select your vendor LIST OF EMPLOYEES Employee ID: create your own (example: MM 001) Name: create new Address: create new Telephone : create new Salary: create new (YOU MUST CREATE 5 NEW EMPLOYEES FROM AT LEAST 2 DIFFERENT DEPARTMENT AND POSITIONS) Required: 1. Create additional new record for two customer, two vendor in two inventory record in the system 2. Create two sales order and two invoice form for each one of your customer and then enter this data into the system 3. Receive payment from at least from any four of your customers at the end of the month 4. Create at least two purchases order and two purchase invoice form for each of your vendor and enter this data into the system 5. Made payment to any three vendors at the end of the month Additional information during the month of March, 2020:- 1. The owner invested $30,000 cash on March 1 2. Paid office rent $5,000 cash on March 31 3. Paid Accounts Payable $40,000 on March 30 4. Paid $8,000 advertising expenses by cash on March 19 Paid $4,000 for maintenance expenses by cash on March 31 & Purchase additional office supplies by check $10,000 on March 20 7. The owner withdraws $10,000 from the business on March 20 Accrued utility expense $5,000 at the end of the month 9.60% of the unearned revenue has been earned 10. The prepaid rent was purchase on 1 January 2019 for 18 month coverage 11. The bank charges of $150 for check printing at the end of the 4. Create at least two purchases order and two purchase invoice form for each of your vendor and enter this data into the system s. Made payment to any three vendors at the end of the month . Additional information during the month of March, 2020:- 1. The owner invested $30,000 cash on March 1 2. Paid office rent $5,000 cash on March 31 3. Paid Accounts Payable $40,000 on March 30 Paid $8,000 advertising expenses by cash on March 19 s. Paid $4,000 for maintenance expenses by cash on March 31 6. Purchase additional office supplies by check $10,000 on March 20 7. The owner withdraws $10,000 from the business on March 20 x. Accrued utility expense $5,000 at the end of the month 9. 60% of the unearned revenue has been earned 10. The prepaid rent was purchase on 1 January 2019 for 18 month coverage 11. The bank charges of $150 for check printing at the end of the month 12. Paid the salary to all the employees at the end of the month 13. The company policy for depreciation is to depreciate all assets at 5% per year on cost using straight line method, the company anticipate that the assets will not have a salvage value.. b. The following document need to be included in the report (hard and softcopy) 1 Sales order and sales invoice form 2. Purchase order and purchase invoice form 3. Computation for all employees salary 4. Journal entry for all the transaction 5. Bank account transaction 6. Trial balance 2. Income statement, retained earnings statement and balance sheet. 6:24 1 + ACCT322-Project Question SE... accounting software. YOU NEED TO START RECORDING YOUR TRANSACTION FOR the month of MARCH, 2020. The following balances occurred in your account as at 1 MARCH 2019. The company existing customer is as follows: Customer ID: Maha 01 Name: Maha Ahmed Billing Address: create new Telephone 1: 9665077852 E-mail: maha@email.com History Customer since: December 31 (last year) Sales Info: GL Sales Acct: Merchandise Sales-(name your product - 1) Customer ID: JS 002 Name: Julia Salman Billing Address: create new Telephone 1: 05372559 E-mail: julia@email.com History: Customer since: December 25 (last year) Sales Info: GL Sales Acct: Merchandise Sales-(name your product - 2) Customer ID: create new Name: create new Billing Address: create new Telephone 1: create new E-mail: create new History Customer since: December i st year SOOS OOOOO Billing Address create new Telephone 1: 9665077852 E-mail: maha@email.com History: Customer since: December 31 (last year) Sales Info: GL Sales Acct: Merchandise Sales-(name your product - 1) Customer ID: JS 002 Name: Julia Salman Billing Address: create new Telephone 1: 05372559 E-mail: julia@email.com History Customer since: December 25 (last year) Sales Info: GL Sales Acct: Merchandise Sales-(name your product - 2) Customer ID: create new Name: create new Billing Address: create new Telephone 1: create new E-mail: create new History: Customer since: December 31 (last year) Sales Info: GL Sales Acct: Merchandise Sales-(name your product - 3) VENDOR list as at 1 January are as follows: Vendor ID: AB 01 Name: ABC Company Contact: Sahar Mailing Address: create new Vendor Type: Supplier 1099 Type: Independent Contractor Expense Account: Inventory- (name your product - 1) Telephone 1: 0143200227 Fax: 0143200238 E-mail: sahar@ab.biz History: Vendor Since: December 31 (last year) Vendor ID: DZ 02 Name: DZ Ltd Contact: Dania Abdullah Mailing Address: create new Vendor Type: Supplier 1099 Type: Independent Contractor Expense Account: Inventory- (name your product - 2) Telephone 1: 0147255638 Fax: 0147255678 E-mail: dania@dz.biz History: Vendor Since: December 15 (last year) Vendor ID: create new Name: create new Contact: create new Mailing Address: create new Vendor Type: Supplier 1099 Type: Independent Contractor Expense Account: Inventory- (name your product - 3) Telephone: create new Fax: create new E-mail: create new History: Vendor Since: December 9 (last year) INVENTORY ITEMS Item ID: (name your product - 1) Description: (name your product - 1) Item Class: Stock item Description for Sales: (name your product - 1) Price Level 1: create new Last Unit Cost: create new GL Sales Acct: Merchandise Sales-(name your product - 1) GL Inventory Acct: Inventory- (name your product - 1) GL Cost of Sales Acct: Cost of Goods Sold-(name your product Item Type: (name your product - 1) Stocking U/M: each Minimum Stock: 0.00 Reorder Quantity: 0.00 Preferred Vendor ID: select your vendor Item ID: Description: (name your product - 2) Item Class: Stock item Description for Sales: (name your product-2) Price Level 1: create new Last Unit Cost: create new GL Sales Acct: Merchandise Sales-(name your product - 2) GL Inventory Acct: Inventory- (name your product - 2) GL Cost of Sales Acct: Cost of Goods Sold - (name your product- Item Type: (name your product - 2) Stocking U/M: each Minimum Stock: 0.00 Reorder Quantity: 0.00 Preferred Vendor ID: select your vendor Item ID: Description: (name your product - 3) Item Class: Stock item Description for Sales: Price Level 1: create new Last Unit Cost: create new Last Unit Cost: create new GL Sales Acct: Merchandise Sales- (name your product - 3) GL Inventory Acct: Inventory- (name your product - 3) GL Cost of Sales Acct: Cost of Goods Sold-(name your product- 3) Item Type: (name your product - 3) Stocking U/M: each Minimum Stock: 0.00 Reorder Quantity: 0.00 Preferred Vendor ID: select your vendor LIST OF EMPLOYEES Employee ID: create your own (example: MM 001) Name: create new Address: create new Telephone : create new Salary: create new (YOU MUST CREATE 5 NEW EMPLOYEES FROM AT LEAST 2 DIFFERENT DEPARTMENT AND POSITIONS) Required: 1. Create additional new record for two customer, two vendor in two inventory record in the system 2. Create two sales order and two invoice form for each one of your customer and then enter this data into the system 3. Receive payment from at least from any four of your customers at the end of the month 4. Create at least two purchases order and two purchase invoice form for each of your vendor and enter this data into the system 5. Made payment to any three vendors at the end of the month Additional information during the month of March, 2020:- 1. The owner invested $30,000 cash on March 1 2. Paid office rent $5,000 cash on March 31 3. Paid Accounts Payable $40,000 on March 30 4. Paid $8,000 advertising expenses by cash on March 19 Paid $4,000 for maintenance expenses by cash on March 31 & Purchase additional office supplies by check $10,000 on March 20 7. The owner withdraws $10,000 from the business on March 20 Accrued utility expense $5,000 at the end of the month 9.60% of the unearned revenue has been earned 10. The prepaid rent was purchase on 1 January 2019 for 18 month coverage 11. The bank charges of $150 for check printing at the end of the 4. Create at least two purchases order and two purchase invoice form for each of your vendor and enter this data into the system s. Made payment to any three vendors at the end of the month . Additional information during the month of March, 2020:- 1. The owner invested $30,000 cash on March 1 2. Paid office rent $5,000 cash on March 31 3. Paid Accounts Payable $40,000 on March 30 Paid $8,000 advertising expenses by cash on March 19 s. Paid $4,000 for maintenance expenses by cash on March 31 6. Purchase additional office supplies by check $10,000 on March 20 7. The owner withdraws $10,000 from the business on March 20 x. Accrued utility expense $5,000 at the end of the month 9. 60% of the unearned revenue has been earned 10. The prepaid rent was purchase on 1 January 2019 for 18 month coverage 11. The bank charges of $150 for check printing at the end of the month 12. Paid the salary to all the employees at the end of the month 13. The company policy for depreciation is to depreciate all assets at 5% per year on cost using straight line method, the company anticipate that the assets will not have a salvage value.. b. The following document need to be included in the report (hard and softcopy) 1 Sales order and sales invoice form 2. Purchase order and purchase invoice form 3. Computation for all employees salary 4. Journal entry for all the transaction 5. Bank account transaction 6. Trial balance 2. Income statement, retained earnings statement and balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts