Question: 6-25 Bond value and time: changing required returns Anil Patel is considering investing in either of two outstanding bonds. The bonds both have 10,000 par

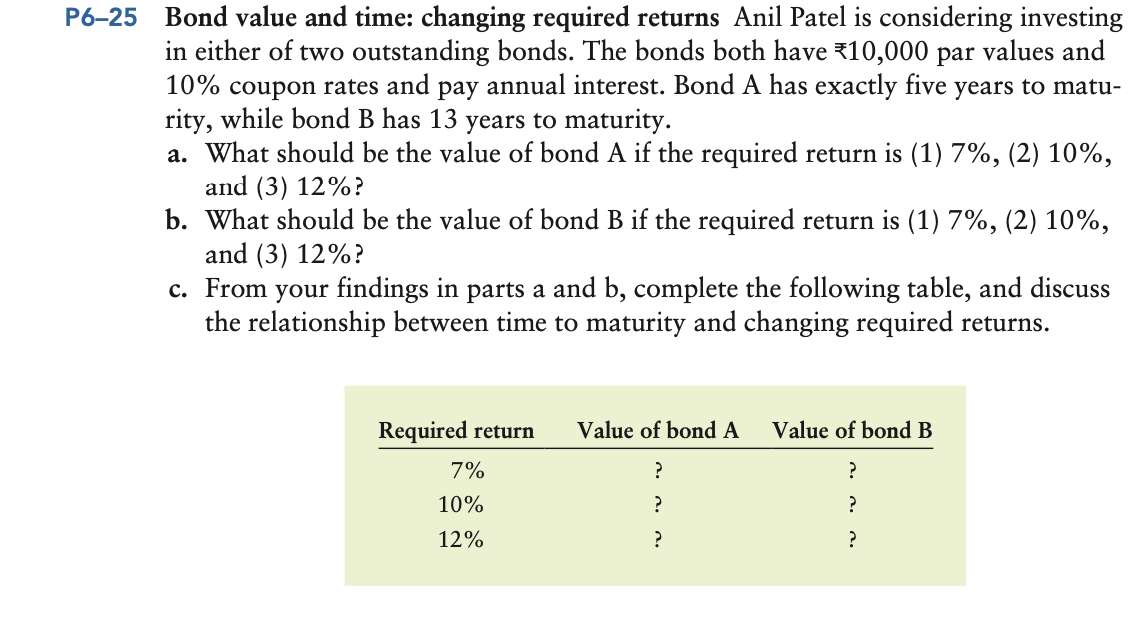

6-25 Bond value and time: changing required returns Anil Patel is considering investing in either of two outstanding bonds. The bonds both have 10,000 par values and 10% coupon rates and pay annual interest. Bond A has exactly five years to maturity, while bond B has 13 years to maturity. a. What should be the value of bond A if the required return is (1) 7%,(2)10%, and (3) 12% ? b. What should be the value of bond B if the required return is (1) 7%, (2) 10%, and (3) 12% ? c. From your findings in parts a and b, complete the following table, and discuss the relationship between time to maturity and changing required returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts