Question: 65. 66. 63. 64. E. A. B. CAUAN CAVA C. Inventory becomes part of cost of goods sold when a company purchases the inventory

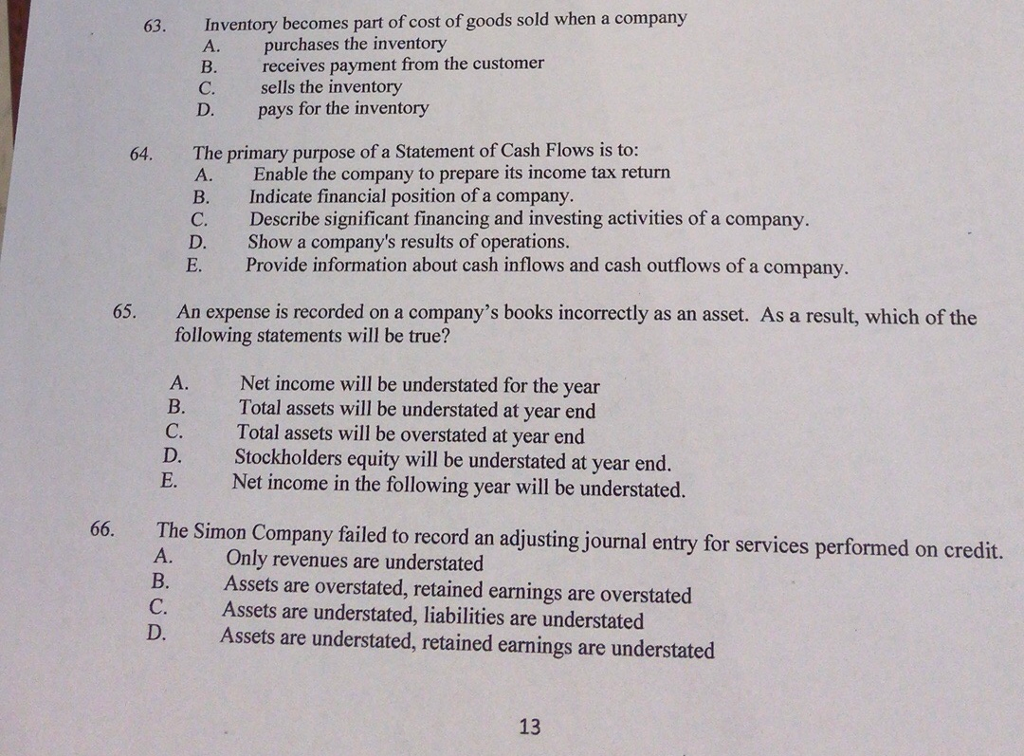

65. 66. 63. 64. E. A. B. CAUAN CAVA C. Inventory becomes part of cost of goods sold when a company purchases the inventory receives payment from the customer sells the inventory pays for the inventory A. B. C. D. The primary purpose of a Statement of Cash Flows is to: A. Enable the company to prepare its income tax return Indicate financial position of a company. Describe significant financing and investing activities of a company. Show a company's results of operations. Provide information about cash inflows and cash outflows of a company. B. C. D. E. An expense is recorded on a company's books incorrectly as an asset. As a result, which of the following statements will be true? The Simon Company failed to record an adjusting journal entry for services performed on credit. Only revenues are understated Net income will be understated for the year Total assets will be understated at year end Total assets will be overstated at year end Stockholders equity will be understated at year end. Net income in the following year will be understated. Assets are overstated, retained earnings are overstated Assets are understated, liabilities are understated Assets are understated, retained earnings are understated 13

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

1 Inventory becomes part of good sold only when we sell the inventory ie option c as ... View full answer

Get step-by-step solutions from verified subject matter experts