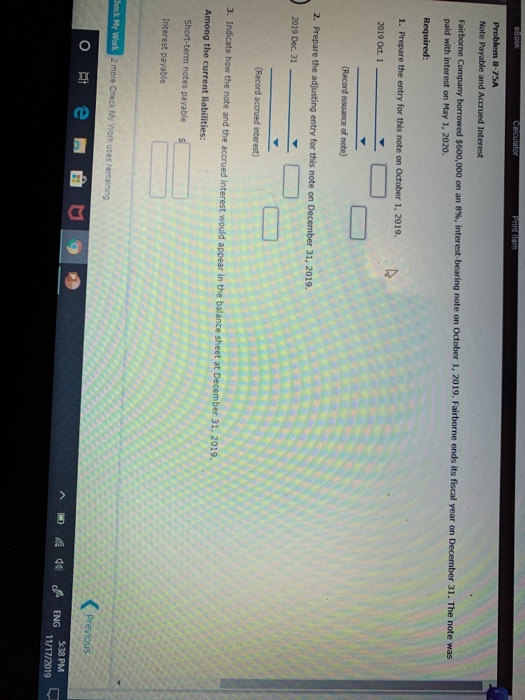

Question: 6500k Calculator Print tem Problem 8-75A Note Payable and Accrued Interest Fairborne Company borrowed $600,000 on an 8%, interest-bearing note on October 1, 2019. Fairborne

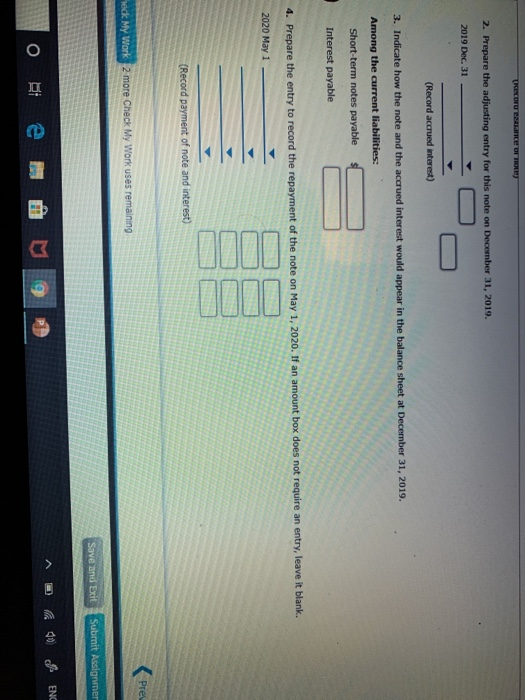

6500k Calculator Print tem Problem 8-75A Note Payable and Accrued Interest Fairborne Company borrowed $600,000 on an 8%, interest-bearing note on October 1, 2019. Fairborne ends its fiscal year on December 31. The note was paid with interest on May 1, 2020. Required: 1. Prepare the entry for this note on October 1, 2019. 2019 Oct. 1 - (Record issuance of note) 2. Prepare the adjusting entry for this note on December 31, 2019. 2019 Dec. 31 (Record accrued interest) 3. Indicate how the note and the accrued interest would appear in the balance sheet at December 31, 2019. Among the current liabilities: Short-term notes payable S Interest payable Check My Work 2 more Check My Work uses remaining OR e Previous M9 M 40 ENG 11/17/2019 $38 PM TROU PALIE OFTE 2. Prepare the adjusting entry for this note on December 31, 2019. 2019 Dec. 31 (Record accrued interest) 3. Indicate how the note and the accrued interest would appear in the balance sheet at December 31, 2019. Among the current liabilities: Short-term notes payable $ Interest payable 4. Prepare the entry to record the repayment of the note on May 1, 2020. If an amount box does not require an entry, leave it blank. 2020 May 1 (Record payment of note and interest) Prey heck My Work 2 more Check My Work uses remaining Save and Exit Submit Assignmer ^ 40 ENC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts