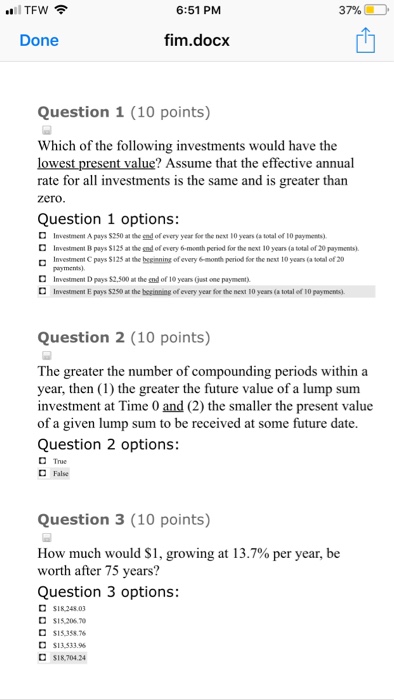

Question: 6:51 PM 37% Done fim.docx Question 1 (10 points) Which of the following investments would have the lowest present value? Assume that the effective annual

6:51 PM 37% Done fim.docx Question 1 (10 points) Which of the following investments would have the lowest present value? Assume that the effective annual rate for all investments is the same and is greater than zero Question 1 options Investment A pays S250 attheg ofevery year krthg next 10years (attal of 10 payments) Investment B pays $125 atthemd ofevery 6-month period or the next 10years'a total of20payments). Investment C pays $125 atthetssening ofevery 6-month period forthe next 10years ca total of20 payments) Investment D pays $2.500 Investment Epays$250 at the beginn ng ofevery year forthe next 10 years(attal ef 10 paymens. the md of 10 years 0ust one payment Question 2 (10 points) The greater the number of compounding periods within a year, then (1) the greater the future value of a lump sum investment at Time 0 and (2) the smaller the present value of a given lump sum to be received at some future date. Question 2 options d Tue False Question 3 (10 points) , be How much would $1, growing at 13.7% per year worth after 75 years? Question 3 options: $18.248.03 $15.206.70 $15358.76 s!3.533.96 $18,704.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts