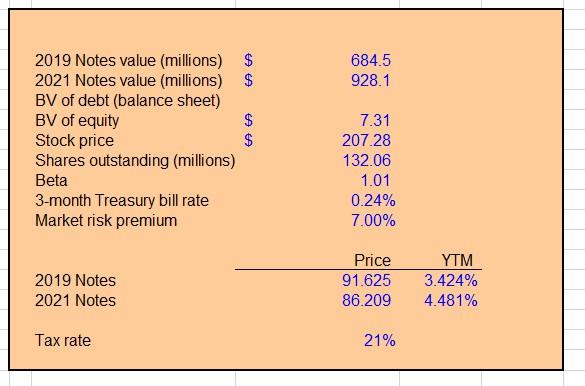

Question: 684.5 928.1 2019 Notes value (millions) $ 2021 Notes value (millions) $ BV of debt (balance sheet) BV of equity $ Stock price $ Shares

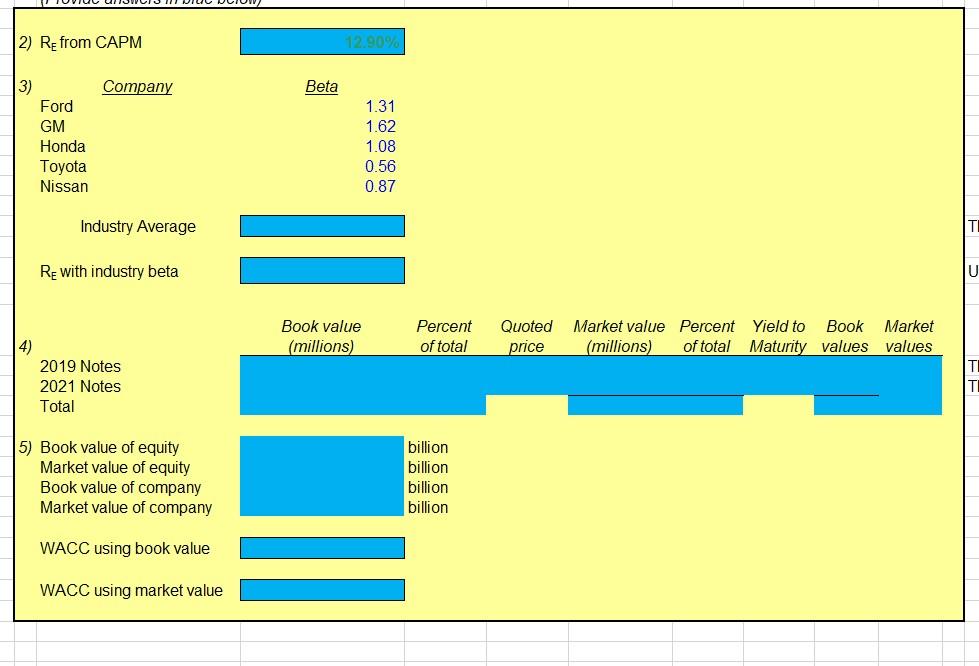

684.5 928.1 2019 Notes value (millions) $ 2021 Notes value (millions) $ BV of debt (balance sheet) BV of equity $ Stock price $ Shares outstanding (millions) Beta 3-month Treasury bill rate Market risk premium 7.31 207.28 132.06 1.01 0.24% 7.00% 2019 Notes 2021 Notes Price 91.625 86.209 YTM 3.424% 4.481% Tax rate 21% 2) R from CAPM 12.909 3) Company Beta Ford GM Honda Toyota Nissan 1.31 1.62 1.08 0.56 0.87 Industry Average T Re with industry beta U Book value (millions) Percent of total Quoted price Market value Percent Yield to Book Market (millions) of total Maturity values values 4) 2019 Notes 2021 Notes Total 5) Book value of equity Market value of equity Book value of company Market value of company billion billion billion billion WACC using book value WACC using market value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts