Question: 6-9 The pure expectations theory or the expectations hypothesis. asserts that long-term interest rates can be used to estimate future short-term interest rates Based on

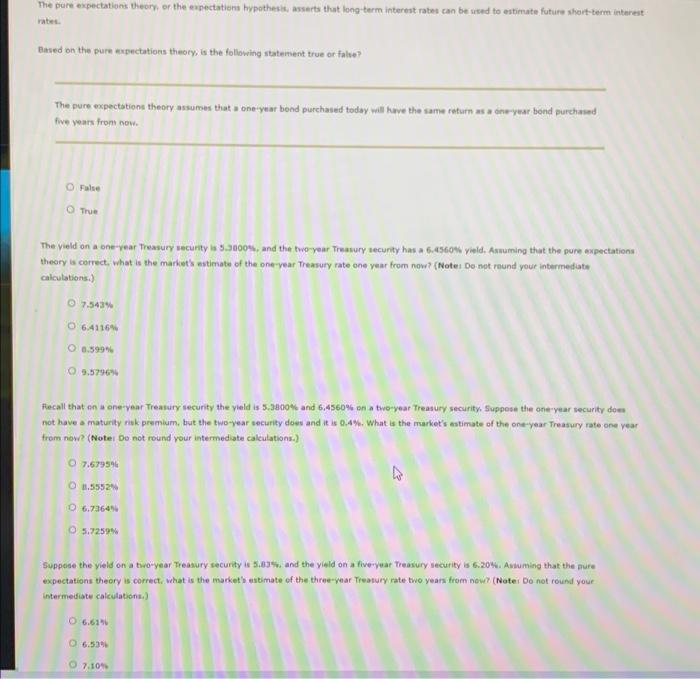

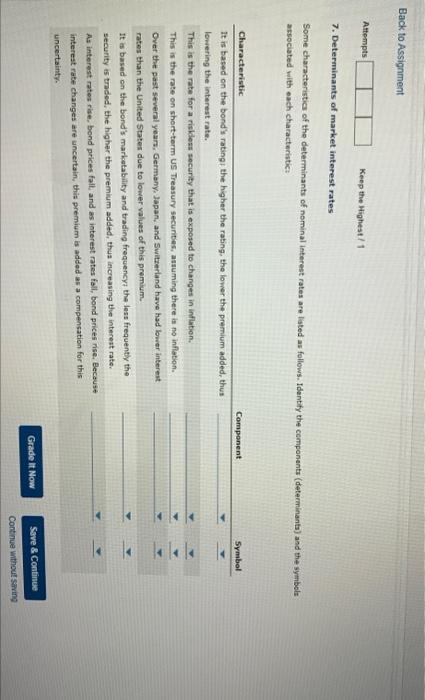

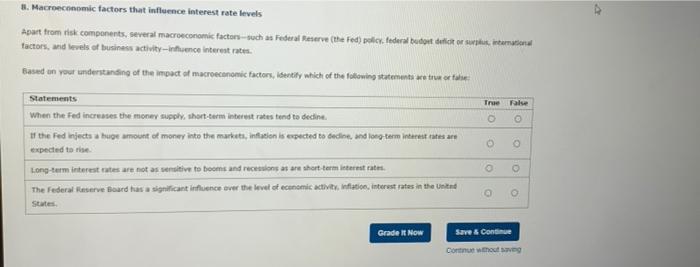

The pure expectations theory or the expectations hypothesis. asserts that long-term interest rates can be used to estimate future short-term interest rates Based on the pure expectations thaoty, is the following statement true or false? The pure expectations theory assume that one-year bond purchased today will have the same return as one-year bond purchased five years from now. O False True The yield on a one-year Treasury security * 3.30004, and the two year Tessury security has a 6.4560 yield. Assuming that the pure expectations theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 7.5434 O 6.4116 6.599 09.57969 Recall that ons one-year Treasury security the yield is 5.3800% and 6,4560% on a two-year Treasury security. Suppose the one year security dom not have a maturity riak premium, but the two-year security dous and it is 0.4% What is the market's estimate of the one-year Treasury rate one year trom now? (Note: Do not round your intermediate calculations.) 7.679594 3.5552 6.73645 5.72594 Suppose the yield on a two-year Treasury security 5.004. and the yuld on a fivereat Treasury security is is 6.209. Asuming that the pure expectations theory is correct, what is the market's estimate of the three-year Treasury rate two years from now? (Note: Do not round your intermediate calculations.) 6.619 6.539 7.10% Back to Assignment Attempts Keep the Highest/ 1 7. Determinants of market interest rates Some characteristics of the determinants of nominal interest rates are listed as follows. Identify the components (determinants) and the symbole associated with each characteristic Component Symbol Characteristic It is based on the bond's rating the higher the rating, the lower the premium added, thus lowering the interest rate. This is the rate for a riskdess security that is exposed to changes in inflation. This is the rate on short-term US Treasury securities, assuming there is no inflation Over the past several years, Germany, Japan, and Switzerland have had lower interest rates than the United States due to lower values of this premium. It is based on the bond's marketability and trading frequency: the less frequently the security is traded, the higher the premium added, thus increasing the interest rate. As interest rates rise bond prices fall, and as interest rates fall, bond prices rise. Because interest rate changes are uncertain, this premium is added as a compensation for this uncertainty. lakk Grade It Now Save & Continue Continue without Saving 3. Macroeconomic factors that influence interest rate levels Apart from risk components, several macroeconomic factors-such as Federal Reserve (the Fed) policy, federal budou duritorum inter tactors, and levels of business activits-Infuence interest rates. Based on your understanding of the impact of macroeconomic factors, identity which of the following statements are true or tale Statements When the Fed increases the money supply, short-term interest rates tend to dedine. of the Fed injects a huge amount of money into the markets, inflation is expected to decine, and long-term interest rates ar expected to rise Long-term interest rates are not as sensitive to booms and recessions are short-term interest rates The Federal Reserve Board has a significant influence over the level of economic activity. Inflation, interest rates in the United True False Grade R Now Save & Continue Continue to save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts