Question: 6B. You can continue to use your less efficient machine at a cost of $10,000 annually for the next five years. Alternatively, you can purchase

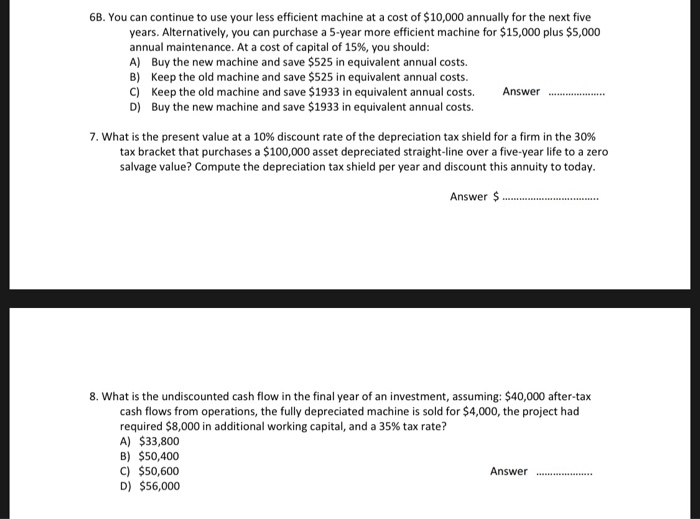

6B. You can continue to use your less efficient machine at a cost of $10,000 annually for the next five years. Alternatively, you can purchase a 5-year more efficient machine for $15,000 plus $5,000 annual maintenance. At a cost of capital of 15%, you should: A) Buy the new machine and save $525 in equivalent annual costs. B) Keep the old machine and save $525 in equivalent annual costs. C) Keep the old machine and save $1933 in equivalent annual costs. Answer ....... D) Buy the new machine and save $1933 in equivalent annual costs. 7. What is the present value at a 10% discount rate of the depreciation tax shield for a firm in the 30% tax bracket that purchases a $100,000 asset depreciated straight-line over a five-year life to a zero salvage value? Compute the depreciation tax shield per year and discount this annuity to today. Answer $ ......... 8. What is the undiscounted cash flow in the final year of an investment, assuming: $40,000 after-tax cash flows from operations, the fully depreciated machine is sold for $4,000, the project had required $8,000 in additional working capital, and a 35% tax rate? A) $33,800 B) $50,400 C) $50,600 Answer D) $56,000 6B. You can continue to use your less efficient machine at a cost of $10,000 annually for the next five years. Alternatively, you can purchase a 5-year more efficient machine for $15,000 plus $5,000 annual maintenance. At a cost of capital of 15%, you should: A) Buy the new machine and save $525 in equivalent annual costs. B) Keep the old machine and save $525 in equivalent annual costs. C) Keep the old machine and save $1933 in equivalent annual costs. Answer ....... D) Buy the new machine and save $1933 in equivalent annual costs. 7. What is the present value at a 10% discount rate of the depreciation tax shield for a firm in the 30% tax bracket that purchases a $100,000 asset depreciated straight-line over a five-year life to a zero salvage value? Compute the depreciation tax shield per year and discount this annuity to today. Answer $ ......... 8. What is the undiscounted cash flow in the final year of an investment, assuming: $40,000 after-tax cash flows from operations, the fully depreciated machine is sold for $4,000, the project had required $8,000 in additional working capital, and a 35% tax rate? A) $33,800 B) $50,400 C) $50,600 Answer D) $56,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts