Question: 6.Both Bond A and Bond B have the same coupon rate Bond A has 12 years to maturity and Bond B has 10 years to

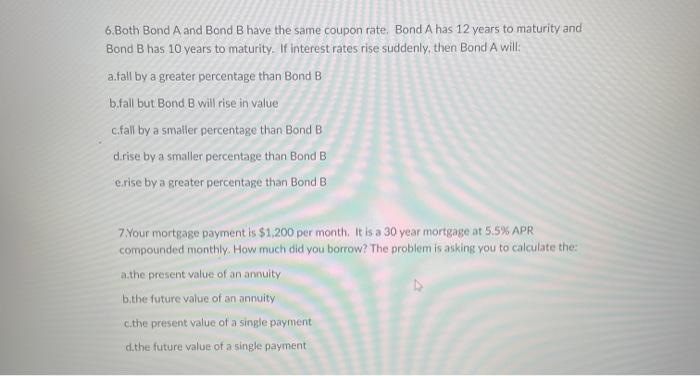

6.Both Bond A and Bond B have the same coupon rate Bond A has 12 years to maturity and Bond B has 10 years to maturity. If interest rates rise suddenly, then Bond A will: a fall by a greater percentage than Bond B b.fall but Bond B will rise in value cfall by a smaller percentage than Bond B d.rise by a smaller percentage than Bond B erise by a greater percentage than Bond B 7 Your mortgage payment is $1.200 per month. It is a 30 year mortgage at 5.5% APR compounded monthly. How much did you borrow? The problem is asking you to calculate the a.the present value of an annuity b.the future value of an annuity cithe present value of a single payment d.the future value of a single payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts