Question: 7 -/1 POINTS BBBASICSTAT7 10.R.004. MY NOTES ASK YOUR TEACHER How profitable are different sectors of the stock market? One way to answer such a

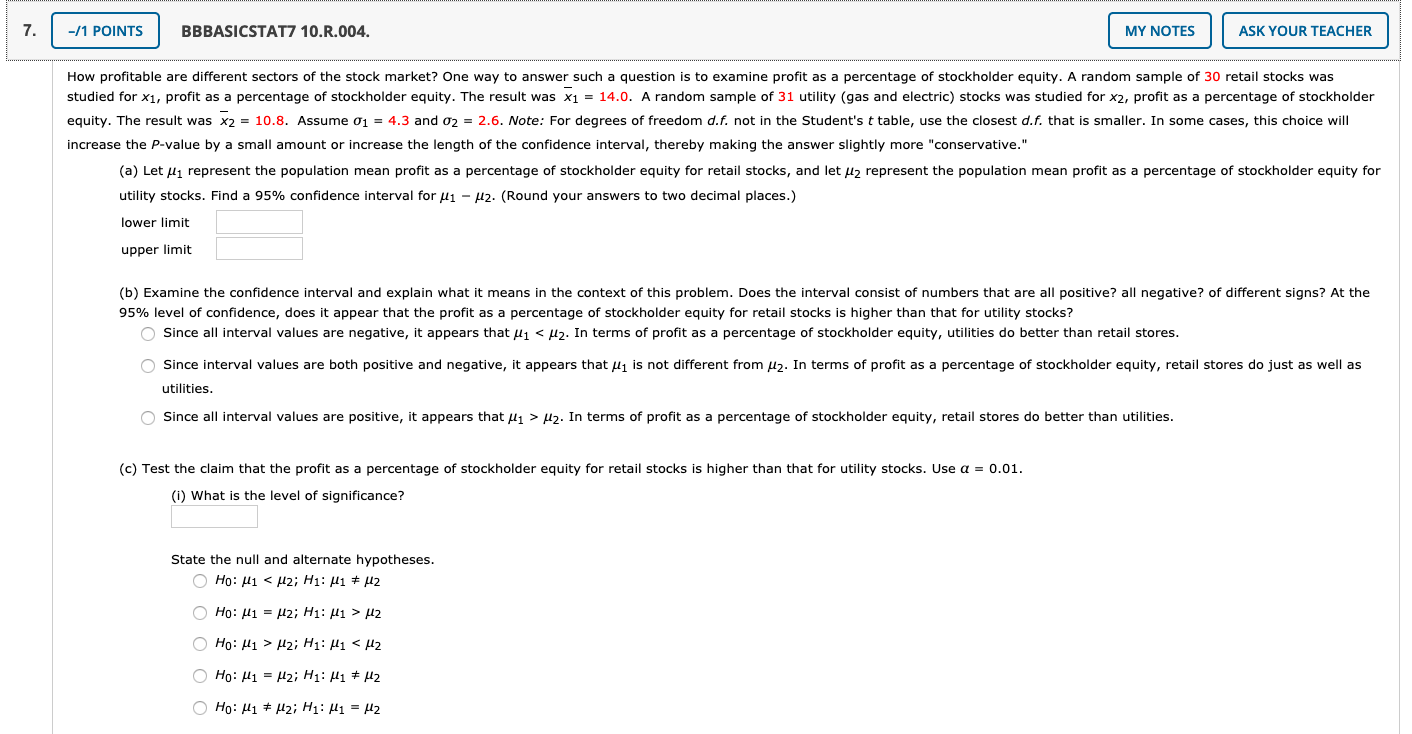

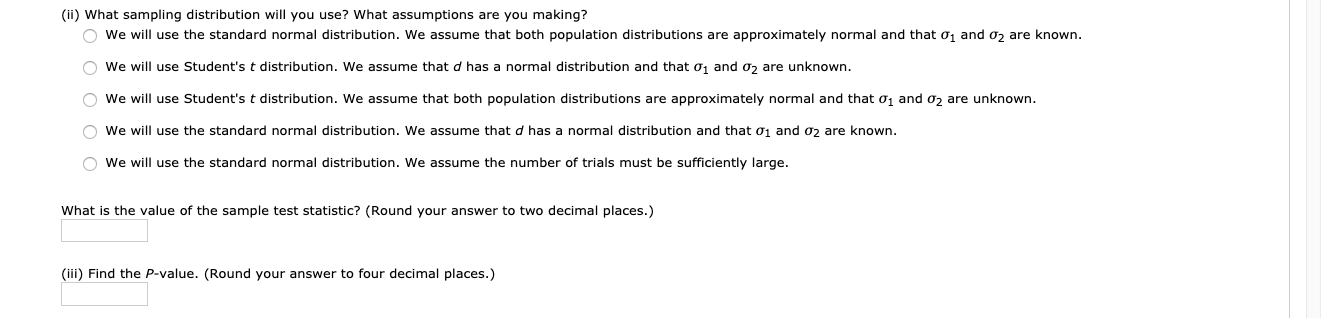

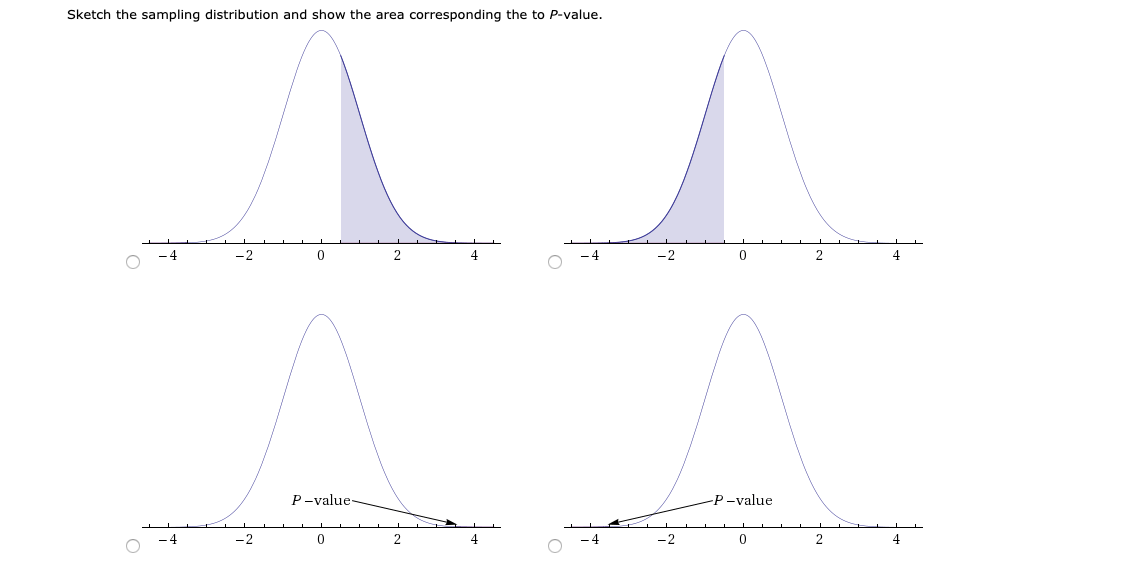

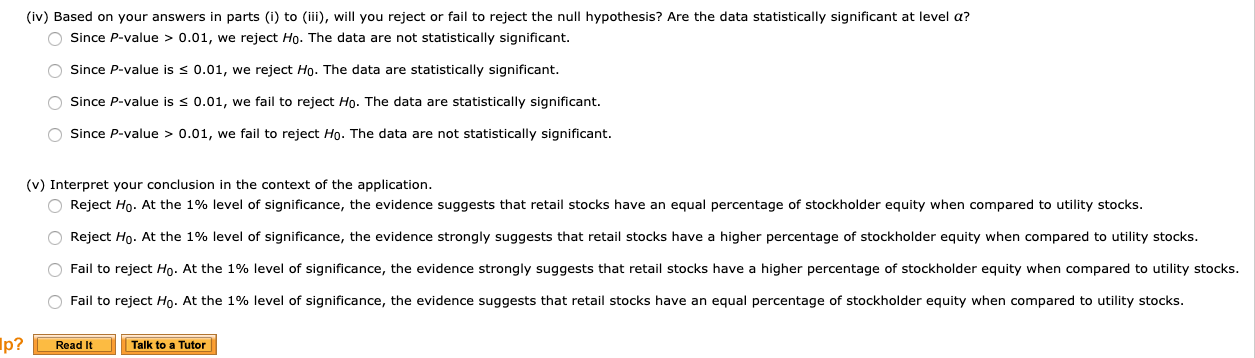

7 -/1 POINTS BBBASICSTAT7 10.R.004. MY NOTES ASK YOUR TEACHER How profitable are different sectors of the stock market? One way to answer such a question is to examine profit as a percentage of stockholder equity. A random sample of 30 retail stocks was studied for x1, profit as a percentage of stockholder equity. The result was x1 = 14.0. A random sample of 31 utility (gas and electric) stocks was studied for x2, profit as a percentage of stockholder equity. The result was x2 = 10.8. Assume 01 = 4.3 and 02 = 2.6. Note: For degrees of freedom d.f. not in the Student's t table, use the closest d.f. that is smaller. In some cases, this choice will increase the P-value by a small amount or increase the length of the confidence interval, thereby making the answer slightly more "conservative." (a) Let /1 represent the population mean profit as a percentage of stockholder equity for retail stocks, and let //2 represent the population mean profit as a percentage of stockholder equity for utility stocks. Find a 95% confidence interval for #1 - /2. (Round your answers to two decimal places.) lower limit upper limit (b) Examine the confidence interval and explain what it means in the context of this problem. Does the interval consist of numbers that are all positive? all negative? of different signs? At the 95% level of confidence, does it appear that the profit as a percentage of stockholder equity for retail stocks is higher than that for utility stocks? Since all interval values are negative, it appears that /1 //2. In terms of profit as a percentage of stockholder equity, retail stores do better than utilities. (c) Test the claim that the profit as a percentage of stockholder equity for retail stocks is higher than that for utility stocks. Use a = 0.01. (i) What is the level of significance? State the null and alternate hypotheses. O Ho: M1 /2 O Ho: H1 > M2; H1: M1 2 O Ho: H1 = #2; H1: M1 # #2 O Ho: M1 # #2; H1: M1 = #2(ii) What sampling distribution will you use? What assumptions are you making? We will use the standard normal distribution. We assume that both population distributions are approximately normal and that Of and 02 are known. O We will use Student's t distribution. We assume that d has a normal distribution and that of and 02 are unknown. O We will use Student's t distribution. We assume that both population distributions are approximately normal and that Of and 02 are unknown. We will use the standard normal distribution. We assume that d has a normal distribution and that of and 02 are known. O We will use the standard normal distribution. We assume the number of trials must be sufficiently large. What is the value of the sample test statistic? (Round your answer to two decimal places.) (iii) Find the P-value. (Round your answer to four decimal places.)Sketch the sampling distribution and show the area corresponding the to P-value. (iv) Based on your answers in parts (i) to (iii), will you reject or fail to reject the null hypothesis? Are the data statistically significant at level a? Since P-value > 0.01, we reject Ho. The data are not statistically significant. Since P-value is s 0.01, we reject Ho. The data are statistically significant. O Since P-value is s 0.01, we fail to reject Ho. The data are statistically significant. O Since P-value > 0.01, we fail to reject Ho. The data are not statistically significant. (v) Interpret your conclusion in the context of the application. O Reject Ho. At the 1% level of significance, the evidence suggests that retail stocks have an equal percentage of stockholder equity when compared to utility stocks. Reject Ho. At the 1% level of significance, the evidence strongly suggests that retail stocks have a higher percentage of stockholder equity when compared to utility stocks. Fail to reject Ho. At the 1% level of significance, the evidence strongly suggests that retail stocks have a higher percentage of stockholder equity when compared to utility stocks. Fail to reject Ho. At the 1% level of significance, the evidence suggests that retail stocks have an equal percentage of stockholder equity when compared to utility stocks. lp? Read It Talk to a Tutor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts