Question: (7) (10 points) Your CIO is asking you to compute each stocks idiosyncratic volatility (i.e. ) using the same monthly data for the previous 5

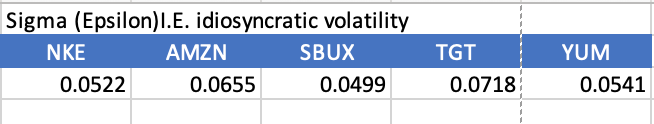

(7) (10 points) Your CIO is asking you to compute each stocks idiosyncratic volatility (i.e. ) using the same monthly data for the previous 5 years. After talking to your investment team, you decide to use the S&P 500 as the market portfolio (SPY).

b) Which stock has the highest and lowest idiosyncratic volatility? Why do you think that is the case?

Please answer why Target has the highest rate and Starbucks has the lowest rate.

Sigma (Epsilon)I.E. idiosyncratic volatility NKE AMZN SBUX 0.0522 0.0655 0.0499 TGT 0.0718 YUM 0.0541 Sigma (Epsilon)I.E. idiosyncratic volatility NKE AMZN SBUX 0.0522 0.0655 0.0499 TGT 0.0718 YUM 0.0541

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock