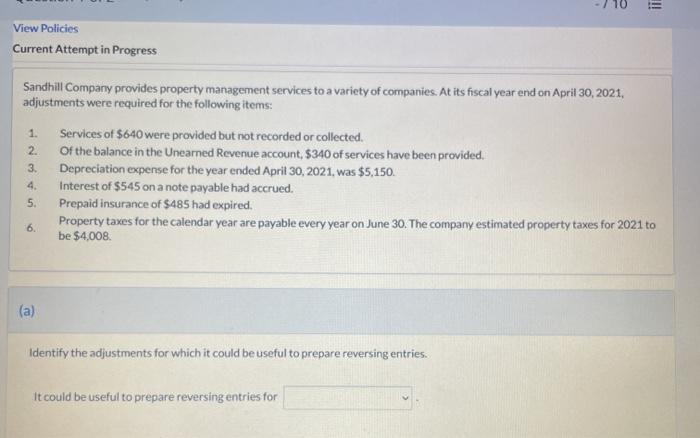

Question: 7 10 View Policies Current Attempt in Progress 1. 2. Sandhill Company provides property management services to a variety of companies. At its fiscal year

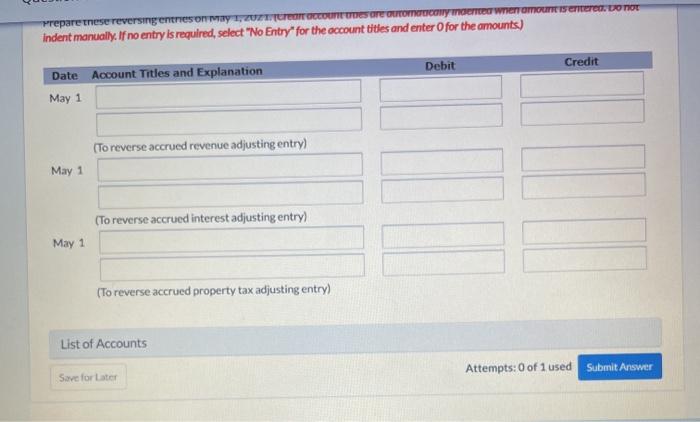

7 10 View Policies Current Attempt in Progress 1. 2. Sandhill Company provides property management services to a variety of companies. At its fiscal year end on April 30, 2021, adjustments were required for the following items: Services of $640 were provided but not recorded or collected of the balance in the Unearned Revenue account, $340 of services have been provided. 3. Depreciation expense for the year ended April 30, 2021, was $5,150. 4. Interest of $545 on a note payable had accrued. 5. Prepaid insurance of $485 had expired. Property taxes for the calendar year are payable every year on June 30. The company estimated property taxes for 2021 to be $4,008 6. (a) Identify the adjustments for which it could be useful to prepare reversing entries. It could be useful to prepare reversing entries for Prepare these reversing entries My TERROG.cores are more con morenen amount is entieren. Do not Indent manually. If no entry is required, select "No Entry for the account tities and enter for the amounts) Debit Credit Date Account Titles and Explanation May 1 (To reverse accrued revenue adjusting entry) May 1 (To reverse accrued interest adjusting entry) May 1 (To reverse accrued property tax adjusting entry) List of Accounts Attempts: 0 of 1 used Submit Answer Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts