Question: 7 - 10 Wrong Long-term bonds have more interest rate risk compared to short term bonds. Long-term bonds receive most of their cash flows farther

7 - 10 Wrong

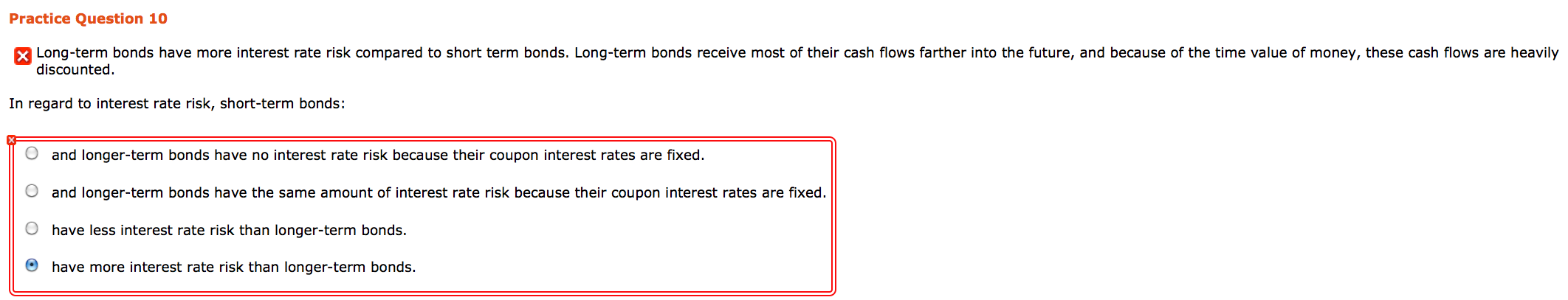

Long-term bonds have more interest rate risk compared to short term bonds. Long-term bonds receive most of their cash flows farther into the future, and because of the time value of money, these cash flows are heavily discounted. In regard to interest rate risk, short-term bonds: and longer-term bonds have no interest rate risk because their coupon interest rates are fixed. and longer-term bonds have the same amount of interest rate risk because their coupon interest rates are fixed. have less interest rate risk than longer-term bonds. have more interest rate risk than longer-term bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts