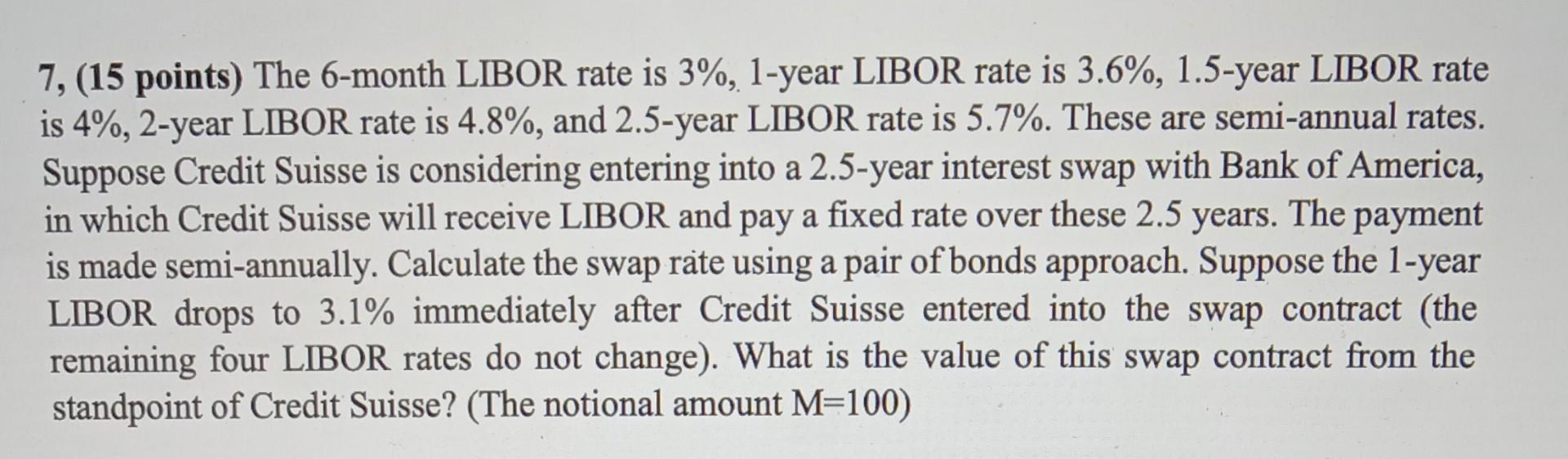

Question: 7, (15 points) The 6-month LIBOR rate is 3%,1-year LIBOR rate is 3.6%, 1.5-year LIBOR rate is 4%,2-year LIBOR rate is 4.8%, and 2.5-year LIBOR

7, (15 points) The 6-month LIBOR rate is 3%,1-year LIBOR rate is 3.6\%, 1.5-year LIBOR rate is 4%,2-year LIBOR rate is 4.8%, and 2.5-year LIBOR rate is 5.7\%. These are semi-annual rates. Suppose Credit Suisse is considering entering into a 2.5-year interest swap with Bank of America, in which Credit Suisse will receive LIBOR and pay a fixed rate over these 2.5 years. The payment is made semi-annually. Calculate the swap rate using a pair of bonds approach. Suppose the 1-year LIBOR drops to 3.1% immediately after Credit Suisse entered into the swap contract (the remaining four LIBOR rates do not change). What is the value of this swap contract from the standpoint of Credit Suisse? (The notional amount M=100 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts