Question: 7 2.5 points You expect a stock's future dividends will grow at a constant rate of 2.3% per year. If its next expected dividend of

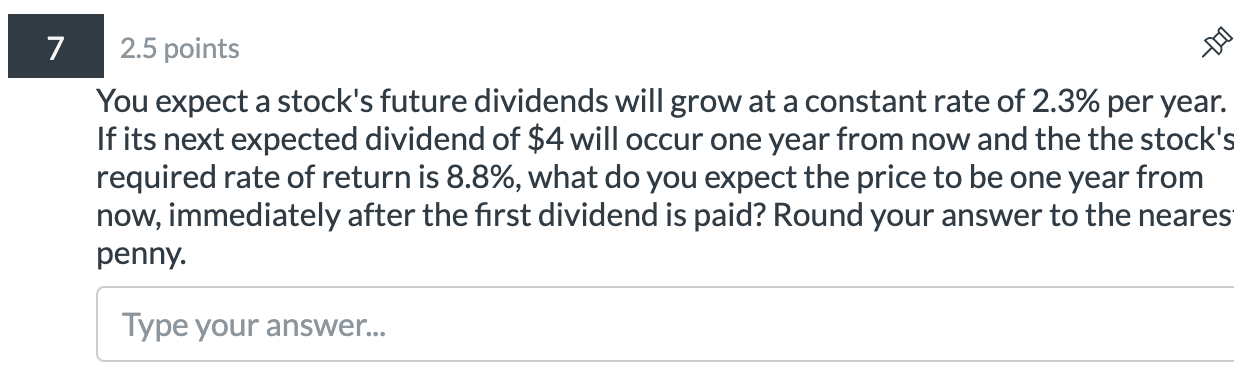

7 2.5 points You expect a stock's future dividends will grow at a constant rate of 2.3% per year. If its next expected dividend of $4 will occur one year from now and the the stock's required rate of return is 8.8%, what do you expect the price to be one year from now, immediately after the first dividend is paid? Round your answer to the neares penny. Type your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts