Question: 7. (3 points; 1 point each; no partial credit) a) You purchase one IBM July 2020 call contract (1 contract = 100 options) for a

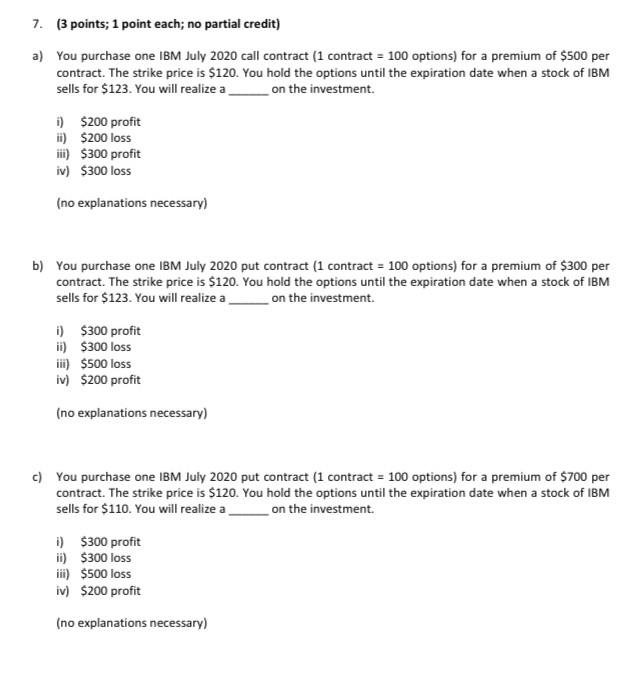

7. (3 points; 1 point each; no partial credit) a) You purchase one IBM July 2020 call contract (1 contract = 100 options) for a premium of $500 per contract. The strike price is $120. You hold the options until the expiration date when a stock of IBM sells for $123. You will realize a__ on the investment. i) $200 profit ii) $200 loss iii) $300 profit iv) $300 loss (no explanations necessary) b) You purchase one IBM July 2020 put contract (1 contract = 100 options) for a premium of $300 per contract. The strike price is $120. You hold the options until the expiration date when a stock of IBM sells for $123. You will realize a_ on the investment. i) $300 profit ii) $300 loss iii) $500 loss iv) $200 profit (no explanations necessary) c) You purchase one IBM July 2020 put contract (1 contract = 100 options) for a premium of $700 per contract. The strike price is $120. You hold the options until the expiration date when a stock of IBM sells for $110. You will realize a_ on the investment. i) $300 profit ii) $300 loss iii) $500 loss iv) $200 profit (no explanations necessary)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts