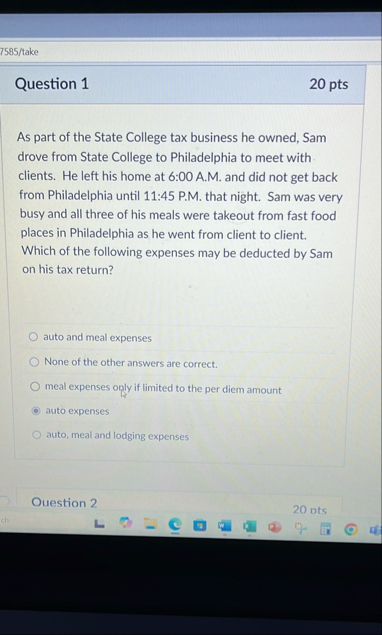

Question: 7 5 8 5 / take Question 1 2 0 pts As part of the State College tax business he owned, Sam drove from State

take

Question

pts

As part of the State College tax business he owned, Sam drove from State College to Philadelphia to meet with clients. He left his home at : AM and did not get back from Philadelphia until : PM that night. Sam was very busy and all three of his meals were takeout from fast food places in Philadelphia as he went from client to client. Which of the following expenses may be deducted by Sam on his tax return?

auto and meal expenses

None of the other answers are correct.

meal expenses only if limited to the per diem amount

auto expenses

auto, meal and lodging expenses

Ouestion

bts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock