Question: 7 . 6 9 PR 4 - 2 ( LO 4 . 2 ) Compute the DuPont ratios ( profit margin, asset turnover, and financial

PR LO Compute the DuPont ratios profit margin, asset turnover, and financial leverage ratios for Amazon and Kroger from to given their performance from

points to

Required:

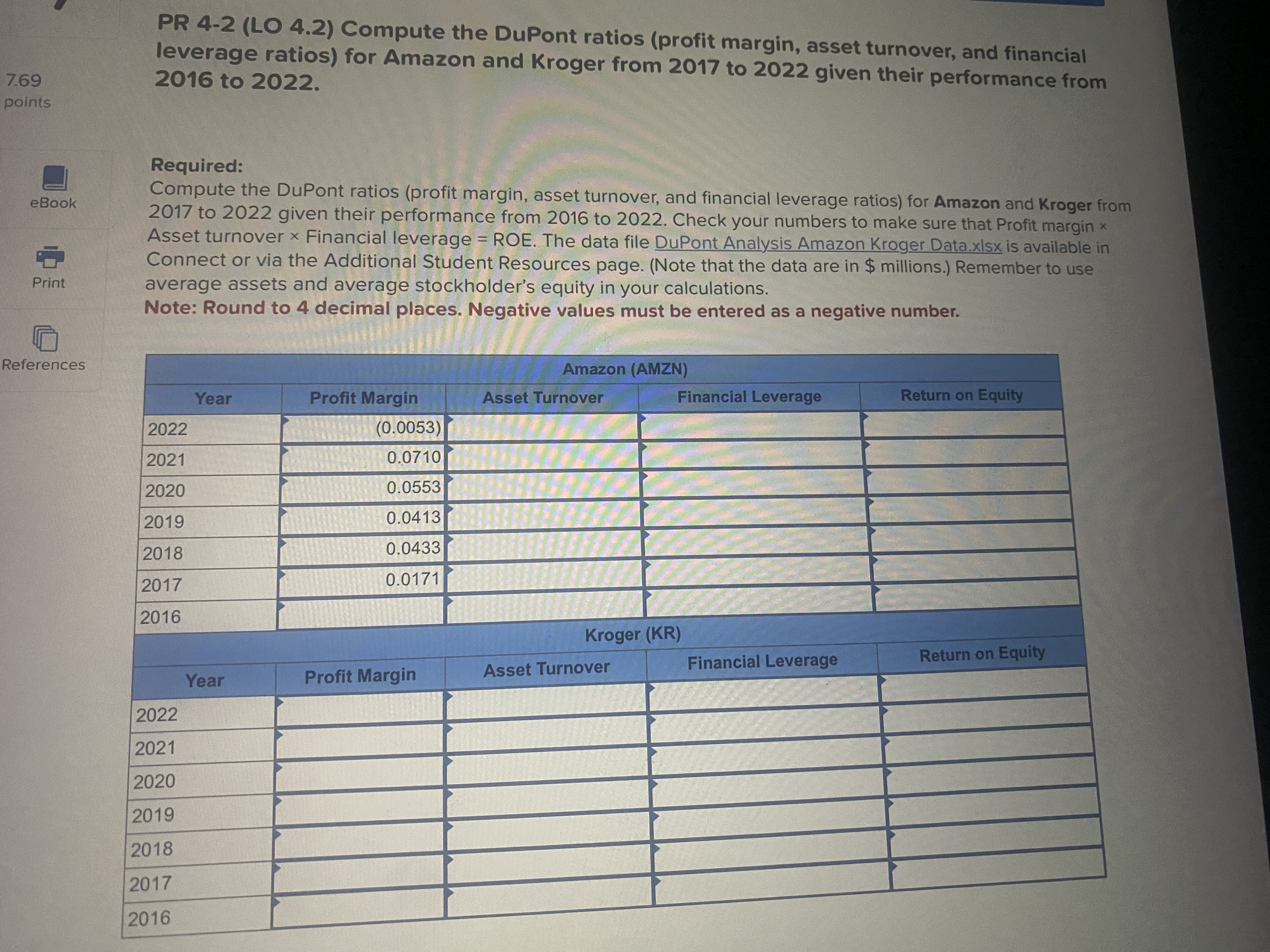

Compute the DuPont ratios profit margin, asset turnover, and financial leverage ratios for Amazon and Kroger from to given their performance from to Check your numbers to make sure that Profit margin Asset turnover Financial leverage ROE. The data file DuPont Analysis Amazon Kroger Data.xlsx is available in Connect or via the Additional Student Resources page. Note that the data are in $ millions. Remember to use average assets and average stockholder's equity in your calculations.

Note: Round to decimal places. Negative values must be entered as a negative number.

References

tableAmazon AMZNYearProfit Margin,Asset Turnover,Financial Leverage,Return on Equity Kroger KRYearProfit Margin,Asset Turnover,Financial Leverage,Return on Equity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock