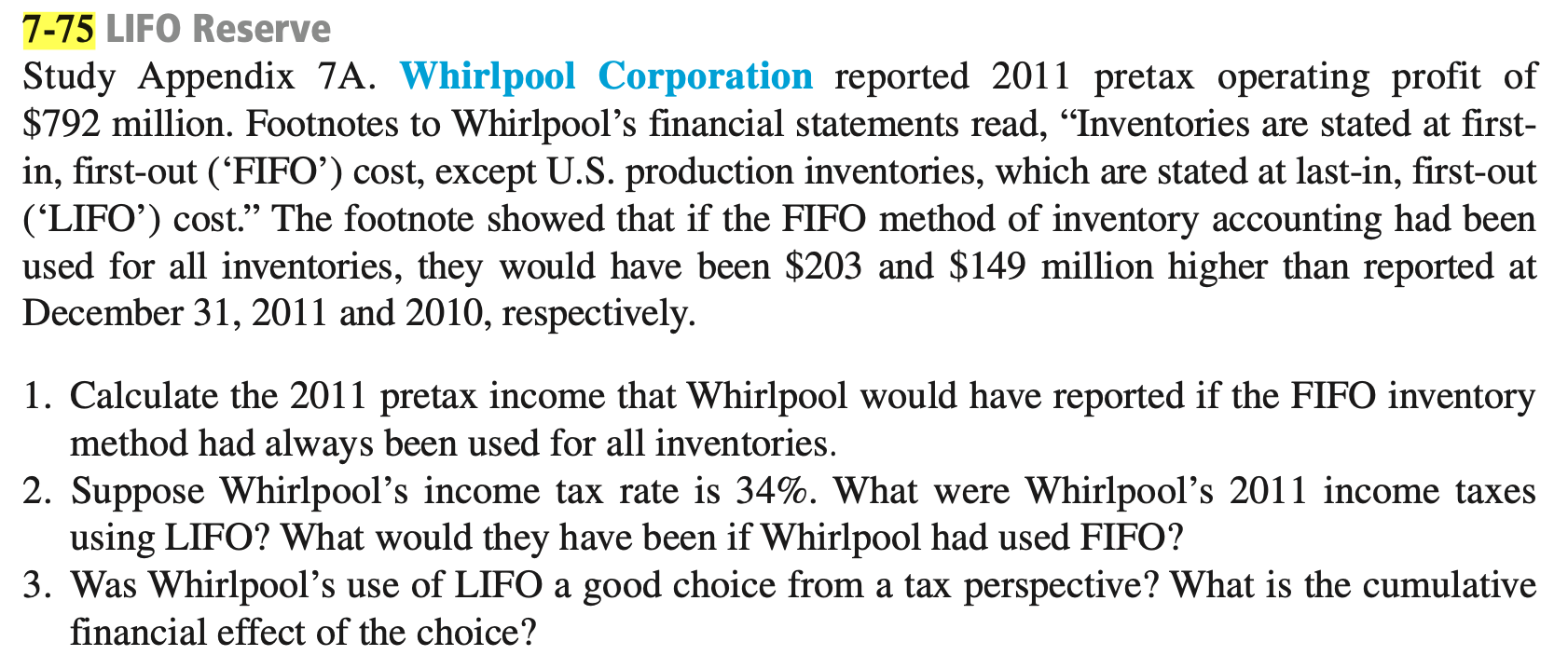

Question: 7 - 7 5 LIIF 0 Reserve Study Appendix 7 A . Whirlpool Corporation reported 2 0 1 1 pretax operating profit of $ 7

LIIF Reserve

Study Appendix A Whirlpool Corporation reported pretax operating profit of

$ million. Footnotes to Whirlpool's financial statements read, "Inventories are stated at first

in firstout FIFO cost except US production inventories, which are stated at lastin firstout

LIFO cost The footnote showed that if the FIFO method of inventory accounting had been

used for all inventories, they would have been $ and $ million higher than reported at

December and respectively.

Calculate the pretax income that Whirlpool would have reported if the FIFO inventory

method had always been used for all inventories.

Suppose Whirlpool's income tax rate is What were Whirlpool's income taxes

using LIFO? What would they have been if Whirlpool had used FIFO?

Was Whirlpool's use of LIFO a good choice from a tax perspective? What is the cumulative

financial effect of the choice?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock