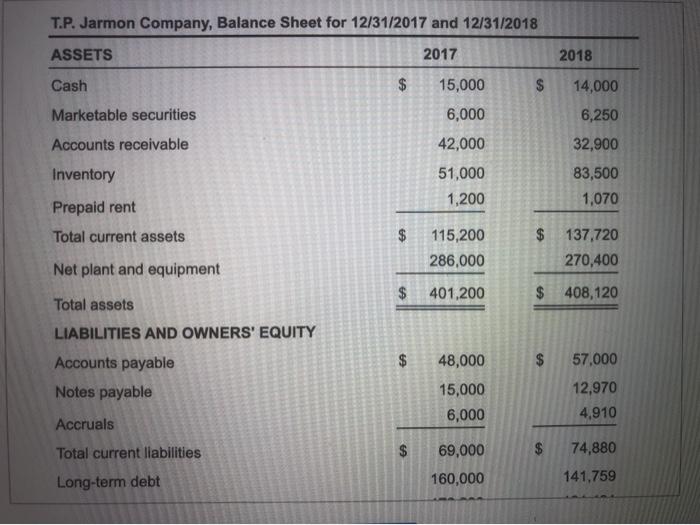

Question: 7 7 missing boxes T.P. Jarmon Company, Balance Sheet for 12/31/2017 and 12/31/2018 ASSETS 2017 2018 Cash $ 15,000 $ 14,000 Marketable securities 6,250 6,000

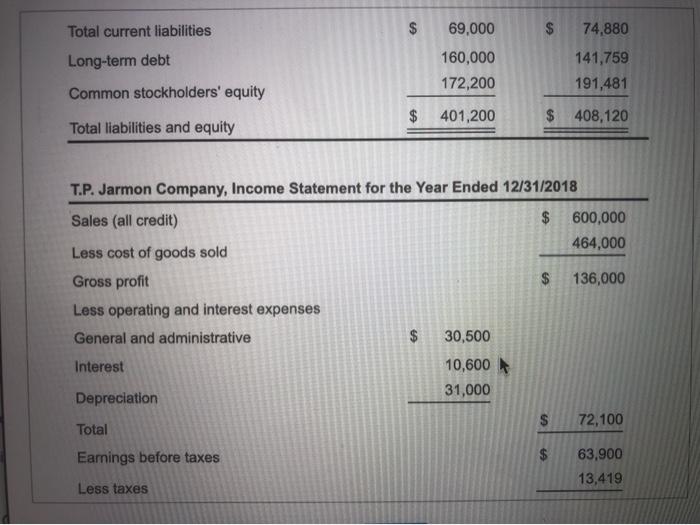

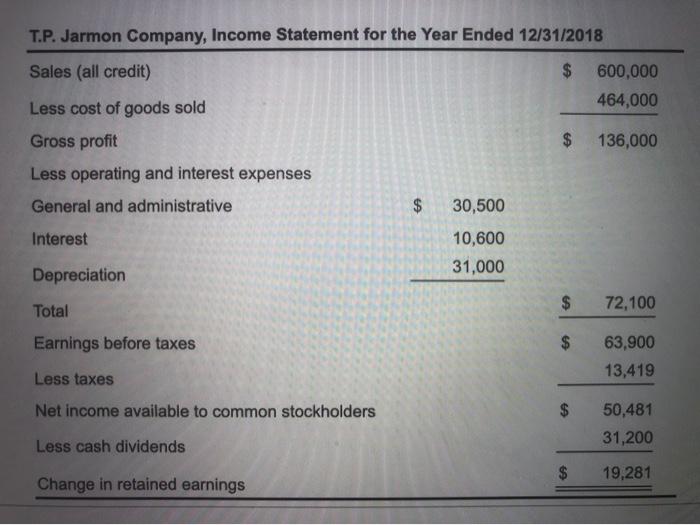

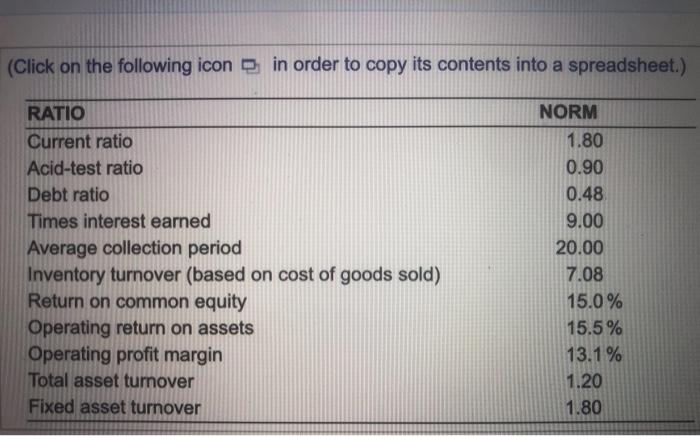

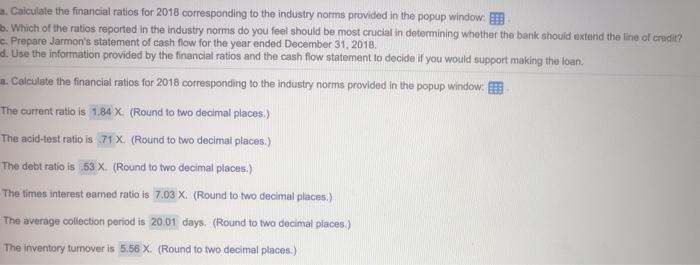

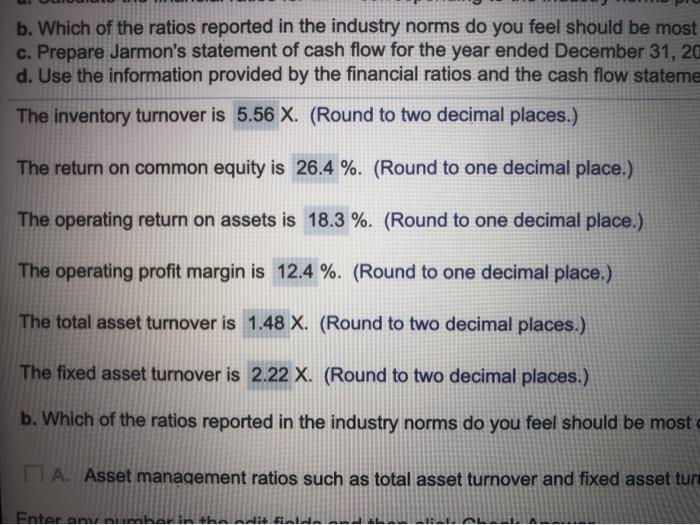

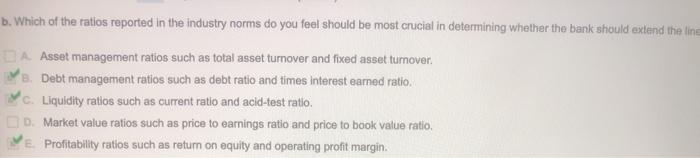

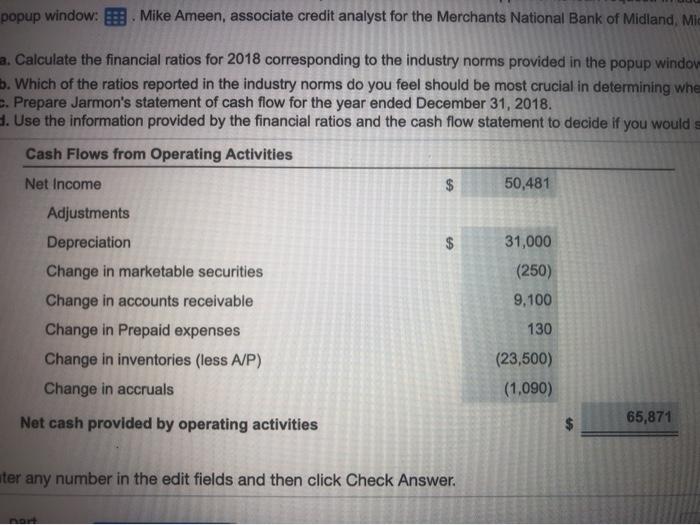

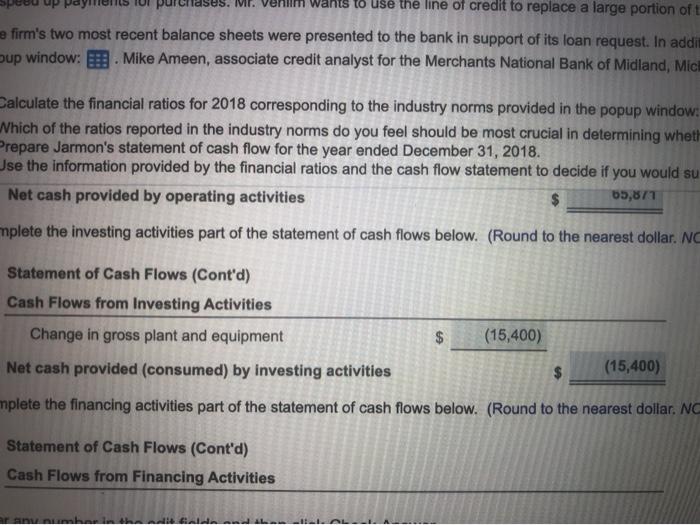

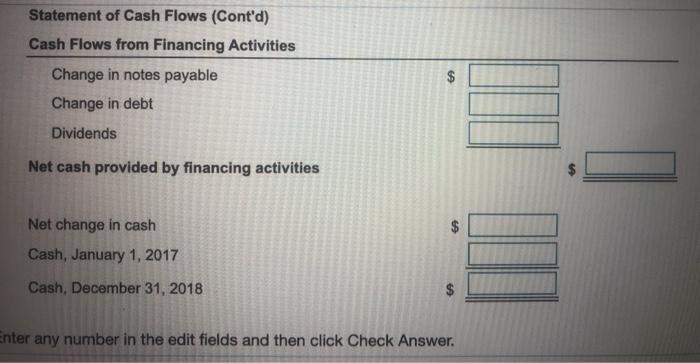

T.P. Jarmon Company, Balance Sheet for 12/31/2017 and 12/31/2018 ASSETS 2017 2018 Cash $ 15,000 $ 14,000 Marketable securities 6,250 6,000 42,000 Accounts receivable Inventory 51,000 1,200 32,900 83,500 1,070 Prepaid rent Total current assets $ 115,200 286,000 $ 137,720 270,400 Net plant and equipment $ 401,200 $ 408,120 Total assets LIABILITIES AND OWNERS' EQUITY $ 48,000 Accounts payable Notes payable 15,000 6,000 57.000 12,970 4,910 Accruals Total current liabilities 69,000 $ 74,880 141,759 Long-term debt 160,000 Total current liabilities $ 69,000 $ Long-term debt 160,000 172,200 74,880 141,759 191,481 Common stockholders' equity $ $ 401,200 $ 408,120 Total liabilities and equity T.P. Jarmon Company, Income Statement for the Year Ended 12/31/2018 Sales (all credit) $ 600,000 464,000 $ 136,000 Less cost of goods sold Gross profit Less operating and interest expenses General and administrative Interest 30,500 10,600 31,000 Depreciation $ 72,100 Total Earnings before taxes 63,900 13,419 Less taxes T.P. Jarmon Company, Income Statement for the Year Ended 12/31/2018 Sales (all credit) $ 600,000 464,000 $ 136,000 Less cost of goods sold Gross profit Less operating and interest expenses General and administrative $ Interest 30,500 10,600 31,000 Depreciation $ Total 72,100 Earnings before taxes $ 63,900 13,419 Less taxes Net income available to common stockholders 50,481 31,200 Less cash dividends 19,281 Change in retained earnings (Click on the following icon in order to copy its contents into a spreadsheet.) RATIO Current ratio Acid-test ratio Debt ratio Times interest earned Average collection period Inventory turnover (based on cost of goods sold) Return on common equity Operating return on assets Operating profit margin Total asset turnover Fixed asset turnover NORM 1.80 0.90 0.48 9.00 20.00 7.08 15.0% 15.5% 13.1 % 1.20 1.80 a. Calculate the financial ratios for 2018 corresponding to the industry norms provided in the popup window: 3. Which of the ratios reported in the industry norms do you feel should be most crucial in determining whether the bank should extend the line of credit? c. Prepare Jarmon's statement of cash flow for the year ended December 31, 2018 d. Use the information provided by the financial ratios and the cash flow statement to decide if you would support making the loan. . Calculate the financial ratios for 2018 corresponding to the industry norms provided in the popup window The current ratio is 1.84 X (Round to two decimal places.) The acid-test ratio is 71 X. (Round to two decimal places.) The debt ratio is 53 X (Round to two decimal places.) The times interest earned ratio is 7.03 X. (Round to two decimal places.) The average collection period is 20.01 days. (Round to two decimal places.) The inventory tumover is 5.56 X (Round to two decimal places:) b. Which of the ratios reported in the industry norms do you feel should be most c. Prepare Jarmon's statement of cash flow for the year ended December 31, 20 d. Use the information provided by the financial ratios and the cash flow stateme The inventory turnover is 5.56 X. (Round to two decimal places.) The return on common equity is 26.4 %. (Round to one decimal place.) The operating return on assets is 18.3 %. (Round to one decimal place.) The operating profit margin is 12.4 %. (Round to one decimal place.) The total asset turnover is 1.48 X. (Round to two decimal places.) The fixed asset turnover is 2.22 X. (Round to two decimal places.) b. Which of the ratios reported in the industry norms do you feel should be most I A. Asset management ratios such as total asset turnover and fixed asset tur Enter anw number in the life b. Which of the ratios reported in the industry norms do you feel should be most crucial in determining whether the bank should extend the line DA Asset management ratios such as total asset turnover and fixed asset tumover. a. Debt management ratios such as debt ratio and times interest eamed ratio. c. Liquidity ratios such as current ratio and acid-test ratio. D. Market value ratios such as price to earnings ratio and price to book value ratio. Profitability ratios such as return on equity and operating profit margin. popup window: Mike Ameen, associate credit analyst for the Merchants National Bank of Midland, Mic 3. Calculate the financial ratios for 2018 corresponding to the industry norms provided in the popup windov b. Which of the ratios reported in the industry norms do you feel should be most crucial in determining whe . Prepare Jarmon's statement of cash flow for the year ended December 31, 2018. 3. Use the information provided by the financial ratios and the cash flow statement to decide if you would = Cash Flows from Operating Activities Net Income $ 50,481 $ 31,000 (250) Adjustments Depreciation Change in marketable securities Change in accounts receivable Change in Prepaid expenses Change in inventories (less A/P) Change in accruals 9,100 130 (23,500) (1,090) Net cash provided by operating activities $ 65,871 ater any number in the edit fields and then click Check Answer. purchas Wants to use the line of credit to replace a large portion of firm's two most recent balance sheets were presented to the bank in support of its loan request. In addi up window: Mike Ameen, associate credit analyst for the Merchants National Bank of Midland, Mich Calculate the financial ratios for 2018 corresponding to the industry norms provided in the popup window: Which of the ratios reported in the industry norms do you feel should be most crucial in determining wheth Prepare Jarmon's statement of cash flow for the year ended December 31, 2018. Jse the information provided by the financial ratios and the cash flow statement to decide if you would su Net cash provided by operating activities $ 65,871 mplete the investing activities part of the statement of cash flows below. (Round to the nearest dollar. NC Statement of Cash Flows (Cont'd) Cash Flows from Investing Activities Change in gross plant and equipment Net cash provided (consumed) by investing activities (15,400) (15,400) mplete the financing activities part of the statement of cash flows below. (Round to the nearest dollar. NC Statement of Cash Flows (Cont'd) Cash Flows from Financing Activities ar sinnumeri dhe Statement of Cash Flows (Cont'd) Cash Flows from Financing Activities Change in notes payable Change in debt Dividends $ Net cash provided by financing activities $ Net change in cash Cash, January 1, 2017 Cash, December 31, 2018 Enter any number in the edit fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts