Question: 7) 7) Suppose a five-year bond with a 7% coupon rate and semiannual compounding is trading for a price of $951.58. Expressed as an APR

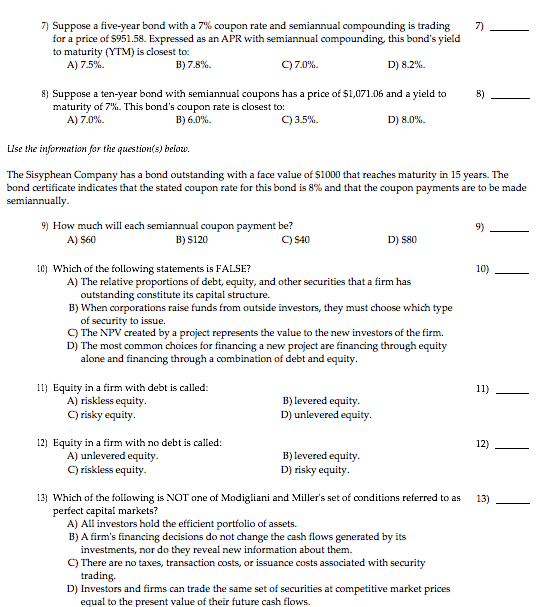

7) 7) Suppose a five-year bond with a 7% coupon rate and semiannual compounding is trading for a price of $951.58. Expressed as an APR with semiannual compounding this band's yield to maturity (YTM) is closest to: A) 7.5%. B) 7.8% 97.0% D) 8.2% 8) Suppose a ten-year bond with semiannual coupons has a price of $1,071.06 and a yield to 8) maturity of 7%. This bond's coupon rate is closest to: A) 7.0% B) 6.0% C)3.5% D) 8.0% Lise the information for the question(s) below. The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 15 years. The bond certificate indicates that the stated coupon rate for this bond is 8% and that the coupon payments are to be made semiannually. 9) How much will each semiannual coupon payment be? 9) A) S60 B) S120 C) S40 D) 580 10) 10) Which of the following statements is FALSE? A) The relative proportions of debt, equity, and other securities that a firm has outstanding constitute its capital structure. B) When corporations raise funds from outside investors, they must choose which type of security to issue. The NPV created by a project represents the value to the new investors of the firm. D) The most common choices for financing a new project are financing through equity alone and financing through a combination of debt and equity. II) Equity in a firm with debt is called: A) riskless equity. B) levered equity. C) risky equity. D) unlevered equity. 12) Equity in a firm with no debt is called: A) unlevered equity. B) levered equity. riskless equity. D) risky equity. 11) 12) 13) 13) Which of the following is NOT one of Modigliani and Miller's set of conditions referred to as perfect capital markets? A) All investors hold the efficient portfolio of assets. B) A firm's financing decisions do not change the cash flows generated by its investments, nor do they reveal new information about them. There are no taxes, transaction costs, or issuance costs associated with security trading D) Investors and firms can trade the same set of securities at competitive market prices equal to the present value of their future cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts