Question: 7 8 9 Interest premium. Estimate the default premium and the maturity premium given the following three investment opportunities: a Treasury bill with a current

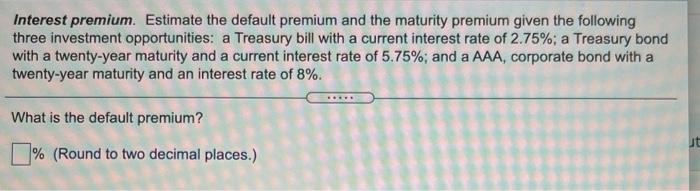

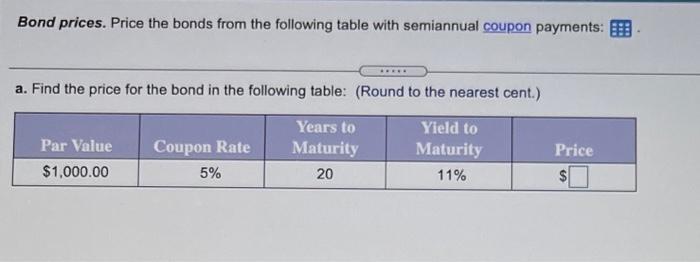

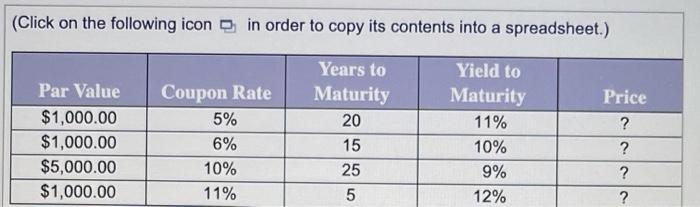

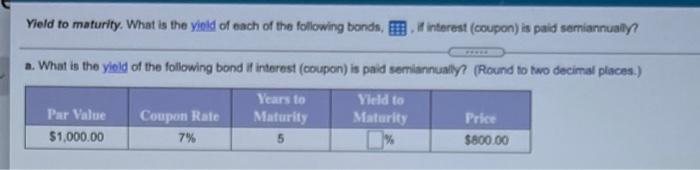

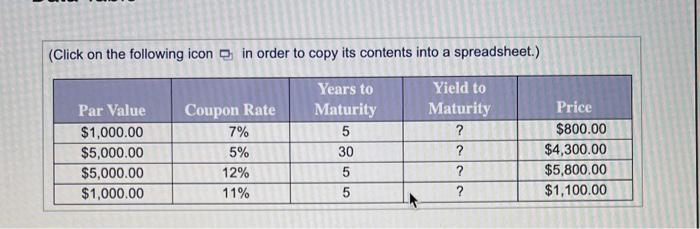

Interest premium. Estimate the default premium and the maturity premium given the following three investment opportunities: a Treasury bill with a current interest rate of 2.75%; a Treasury bond with a twenty-year maturity and a current interest rate of 5.75%; and a AAA, corporate bond with a twenty-year maturity and an interest rate of 8%. What is the default premium? jt % (Round to two decimal places.) Bond prices. Price the bonds from the following table with semiannual coupon payments: RE a. Find the price for the bond in the following table: (Round to the nearest cent.) Years to Yield to Par Value Coupon Rate Maturity Maturity $1,000.00 5% 20 11% Price (Click on the following icon in order to copy its contents into a spreadsheet.) Par Value $1,000.00 $1,000.00 $5,000.00 $1,000.00 Coupon Rate 5% 6% 10% 11% Years to Maturity 20 15 25 5 Yield to Maturity 11% 10% 9% 12% Price ? ? ? ? Yield to maturity. What is the yield of each of the following bonds, if interest (coupon) is paid semiannualy? a. What is the yield of the following bond if interest (coupon) is paid semiannually (Round to two decimal places.) Years to Yield to Par Value Coupon Rate Maturity Maturity Price $1,000.00 7% 5 $800.00 (Click on the following icon in order to copy its contents into a spreadsheet.) Par Value $1,000.00 $5,000.00 $5,000.00 $1,000.00 Coupon Rate 7% 5% 12% 11% Years to Maturity 5 30 5 5 Yield to Maturity ? ? ? 2 Price $800.00 $4,300.00 $5,800.00 $1,100.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts