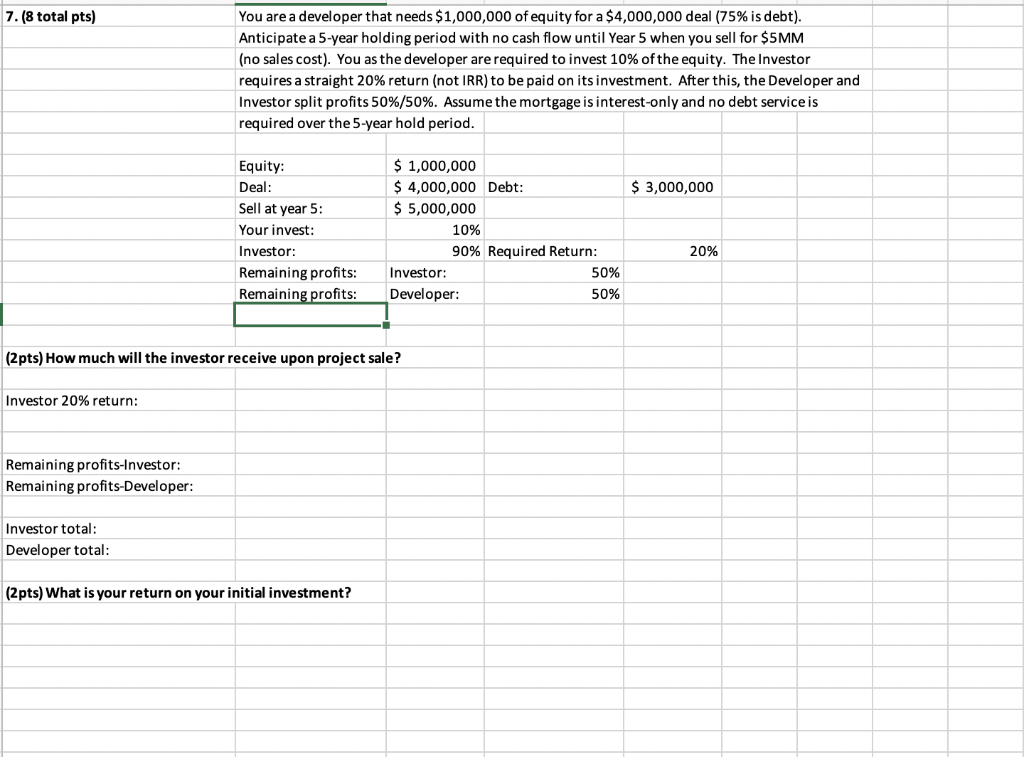

Question: 7. (8 total pts) You are a developer that needs $1,000,000 of equity for a $4,000,000 deal (75% is debt). Anticipate a 5-year holding period

7. (8 total pts) You are a developer that needs $1,000,000 of equity for a $4,000,000 deal (75% is debt). Anticipate a 5-year holding period with no cash flow until Year 5 when you sell for $5MM (no sales cost). You as the developer are required to invest 10% of the equity. The Investor requires a straight 20% return (not IRR) to be paid on its investment. After this, the Developer and Investor split profits 50%/50%. Assume the mortgage is interest-only and no debt service is required over the 5-year hold period. $ 3,000,000 Equity: Deal: Sell at year 5: Your invest: Investor: Remaining profits: Remaining profits: $ 1,000,000 $ 4,000,000 Debt: $ 5,000,000 10% 90% Required Return: Investor: 50% Developer: 50% 20% (2pts) How much will the investor receive upon project sale? Investor 20% return: Remaining profits-Investor: Remaining profits-Developer: Investor total: Developer total: (2pts) What is your return on your initial investment? 7. (8 total pts) You are a developer that needs $1,000,000 of equity for a $4,000,000 deal (75% is debt). Anticipate a 5-year holding period with no cash flow until Year 5 when you sell for $5MM (no sales cost). You as the developer are required to invest 10% of the equity. The Investor requires a straight 20% return (not IRR) to be paid on its investment. After this, the Developer and Investor split profits 50%/50%. Assume the mortgage is interest-only and no debt service is required over the 5-year hold period. $ 3,000,000 Equity: Deal: Sell at year 5: Your invest: Investor: Remaining profits: Remaining profits: $ 1,000,000 $ 4,000,000 Debt: $ 5,000,000 10% 90% Required Return: Investor: 50% Developer: 50% 20% (2pts) How much will the investor receive upon project sale? Investor 20% return: Remaining profits-Investor: Remaining profits-Developer: Investor total: Developer total: (2pts) What is your return on your initial investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts