Question: 7. A bid rate in the foreign exchange quotation is the a) rate a customer pays to the bank when buying currency b) rate a

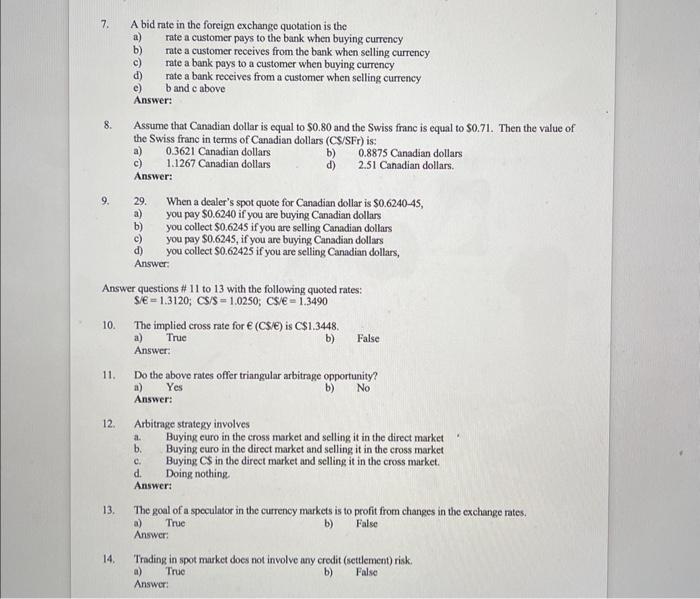

7. A bid rate in the foreign exchange quotation is the a) rate a customer pays to the bank when buying currency b) rate a customer receives from the bank when selling currency c) rate a bank pays to a customer when buying currency d) rate a bank receives from a customer when selling currency e) b and e above Answer: 8. Assume that Canadian dollar is equal to $0.80 and the Swiss franc is equal to $0.71. Then the value of the Swiss frane in terms of Canadian dollars (CS/SFr) is: a) 0.3621 Canadian dollars b) 0.8875 Canadian dollars c) 1.1267 Canadian dollars d) 2.51 Canadian dollars. Answer: 9. 29. When a dealer's spot quote for Canadian dollar is $0.624045, a) you pay $0.6240 if you are buying Canadian dollars b) you collect $0.6245 if you are selling Canadian dollars c) you pay $0.6245, if you are buying Canadian dollars d) you collect $0.62425 if you are selling Canadian dollars, Answer: Answer questions \# 11 to 13 with the following quoted rates: S/=1.3120;CS/S=1.0250;CS/E=1.3490 10. The implied cross rate for (CS/ E) is C $1.3448. a) True Answer: b) False 11. Do the above rates offer triangular arbitrage opportunity? a) Yes b) No Answer: 12. Arbitrage strategy involves a. Buying euro in the cross market and selling it in the direct market b. Buying euro in the direct market and selling it in the cross market c. Buying CS in the direct market and selling it in the cross market. d. Doing nothing. Answer: 13. The goal of a speculator in the currency markets is to profit from changes in the exchange rates. a) True b) False Answer: 14. Trading in spot market does not involve any credit (settlement) risk. a) True b) False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts