Question: 7. A five-year project will cost $2,000,000 to construct. This will be depreciated straight line to zero over the five-year life. The project is expected

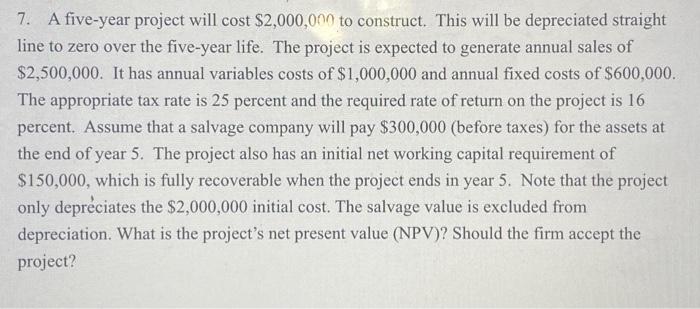

7. A five-year project will cost $2,000,000 to construct. This will be depreciated straight line to zero over the five-year life. The project is expected to generate annual sales of $2,500,000. It has annual variables costs of $1,000,000 and annual fixed costs of $600,000. The appropriate tax rate is 25 percent and the required rate of return on the project is 16 percent. Assume that a salvage company will pay $300,000 (before taxes) for the assets at the end of year 5 . The project also has an initial net working capital requirement of $150,000, which is fully recoverable when the project ends in year 5 . Note that the project only deprciates the $2,000,000 initial cost. The salvage value is excluded from depreciation. What is the project's net present value (NPV)? Should the firm accept the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts