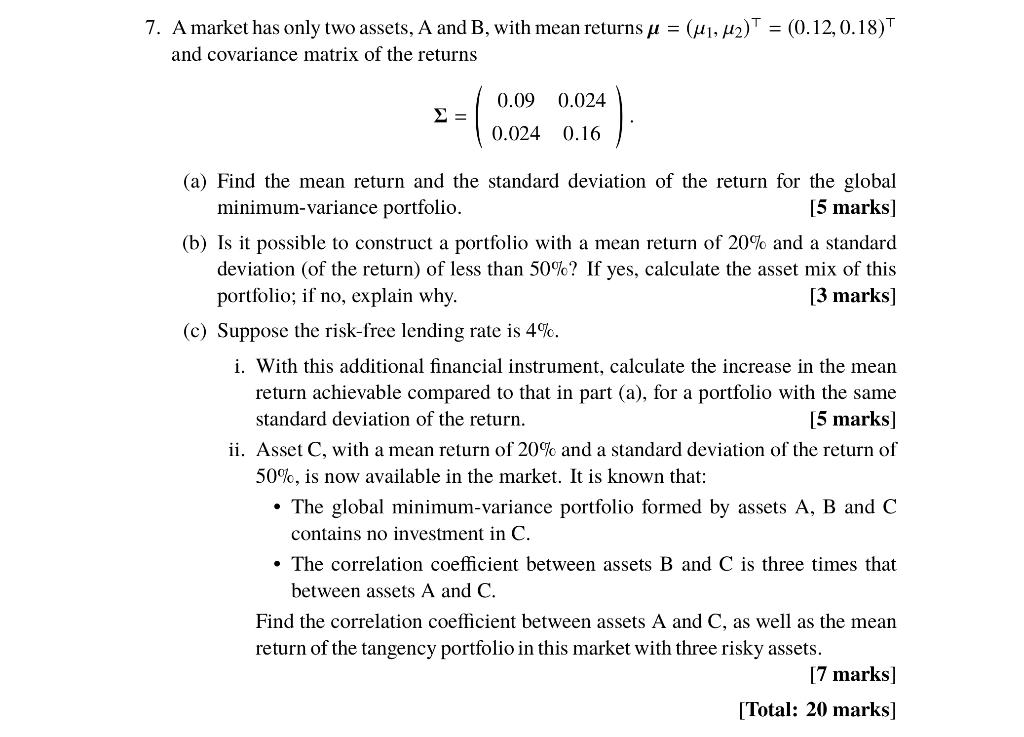

Question: 7. A market has only two assets, A and B, with mean returns u = (41, 42) = (0.12,0.18) and covariance matrix of the returns

7. A market has only two assets, A and B, with mean returns u = (41, 42) = (0.12,0.18) and covariance matrix of the returns 0.09 0.024 = 0.024 0.16 (a) Find the mean return and the standard deviation of the return for the global minimum-variance portfolio. [5 marks] (b) Is it possible to construct a portfolio with a mean return of 20% and a standard deviation (of the return) of less than 50%? If yes, calculate the asset mix of this portfolio; if no, explain why. [3 marks] (c) Suppose the risk-free lending rate is 4%. i. With this additional financial instrument, calculate the increase in the mean return achievable compared to that in part (a), for a portfolio with the same standard deviation of the return. [5 marks] ii. Asset C, with a mean return of 20% and a standard deviation of the return of 50%, is now available in the market. It is known that: The global minimum-variance portfolio formed by assets A, B and C contains no investment in C. The correlation coefficient between assets B and C is three times that between assets A and C. Find the correlation coefficient between assets A and C, as well as the mean return of the tangency portfolio in this market with three risky assets. [7 marks] [Total: 20 marks] 7. A market has only two assets, A and B, with mean returns u = (41, 42) = (0.12,0.18) and covariance matrix of the returns 0.09 0.024 = 0.024 0.16 (a) Find the mean return and the standard deviation of the return for the global minimum-variance portfolio. [5 marks] (b) Is it possible to construct a portfolio with a mean return of 20% and a standard deviation (of the return) of less than 50%? If yes, calculate the asset mix of this portfolio; if no, explain why. [3 marks] (c) Suppose the risk-free lending rate is 4%. i. With this additional financial instrument, calculate the increase in the mean return achievable compared to that in part (a), for a portfolio with the same standard deviation of the return. [5 marks] ii. Asset C, with a mean return of 20% and a standard deviation of the return of 50%, is now available in the market. It is known that: The global minimum-variance portfolio formed by assets A, B and C contains no investment in C. The correlation coefficient between assets B and C is three times that between assets A and C. Find the correlation coefficient between assets A and C, as well as the mean return of the tangency portfolio in this market with three risky assets. [7 marks] [Total: 20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts