Question: 7. A money spread involves buying and selling call options in the same stock with a. The same time period and exercise price. b. The

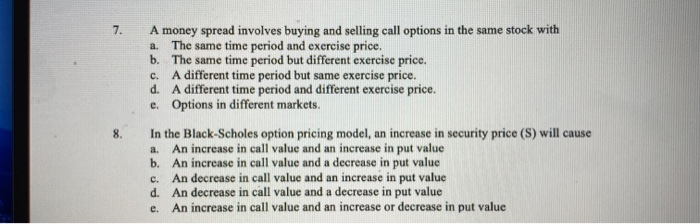

7. A money spread involves buying and selling call options in the same stock with a. The same time period and exercise price. b. The same time period but different exercise price. c. A different time period but same exercise price. d. A different time period and different exercise price. e. Options in different markets. In the Black-Scholes option pricing model, an increase in security price (S) will cause a. An increase in call value and an increase in put value b. An increase in call value and a decrease in put value c. An decrease in call value and an increase in put value d. An decrease in call value and a decrease in put value e. An increase in call value and an increase or decrease in put value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts