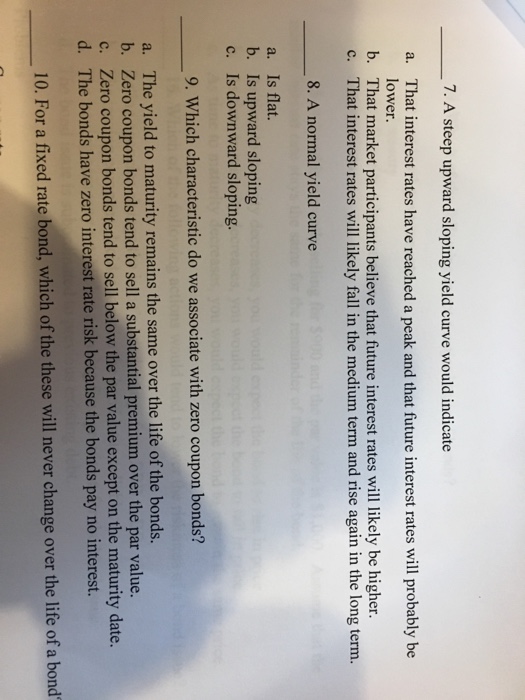

Question: 7. A steep upward sloping yield curve would indicate That interest rates have reached a peak and that future interest rates will probably be lower

7. A steep upward sloping yield curve would indicate That interest rates have reached a peak and that future interest rates will probably be lower a. b. That market participants believe that future interest rates will likely be higher. 8. A normal yield curve a. Is flat. b. Is upward sloping c. Is downward sloping. 9. Which characteristic do we associate with zero coupon bonds? a. The yield to maturity remains the same over the life of the bonds. b. Zero coupon bonds tend to sell a substantial premium over the par value. c. Zero coupon bonds tend to sell below the par value except on the maturity date. d. The bonds have zero interest rate risk because the bonds pay no interest. 10. For a fixed rate bond, which of the these will never change over the life of a bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts