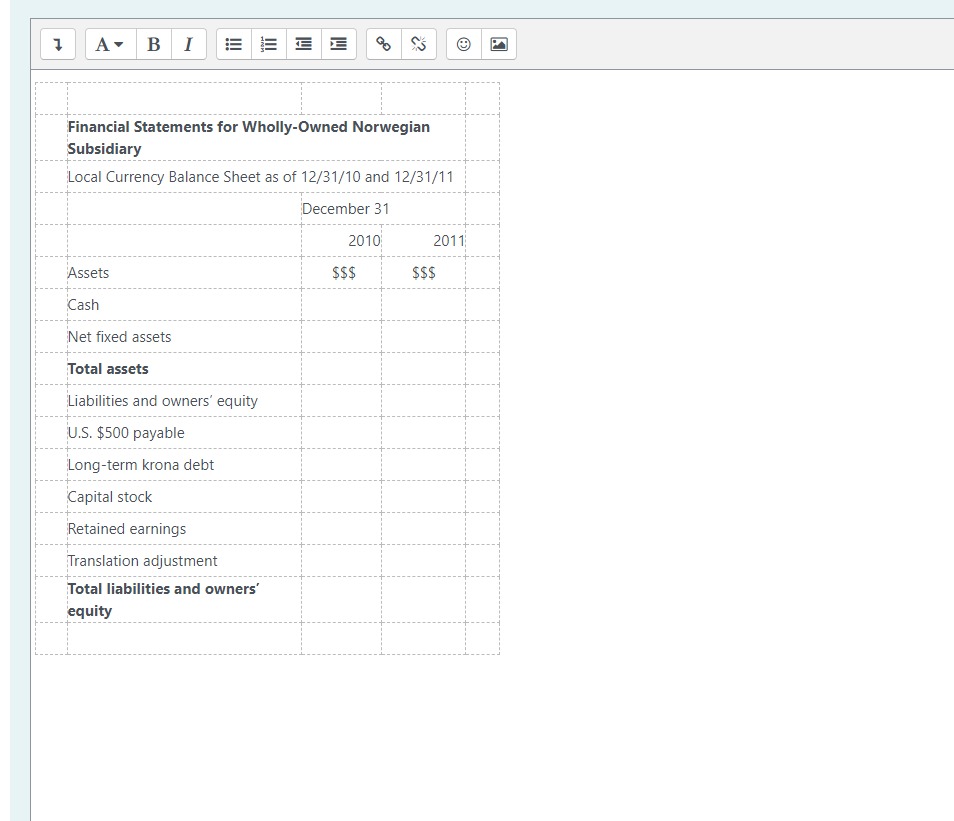

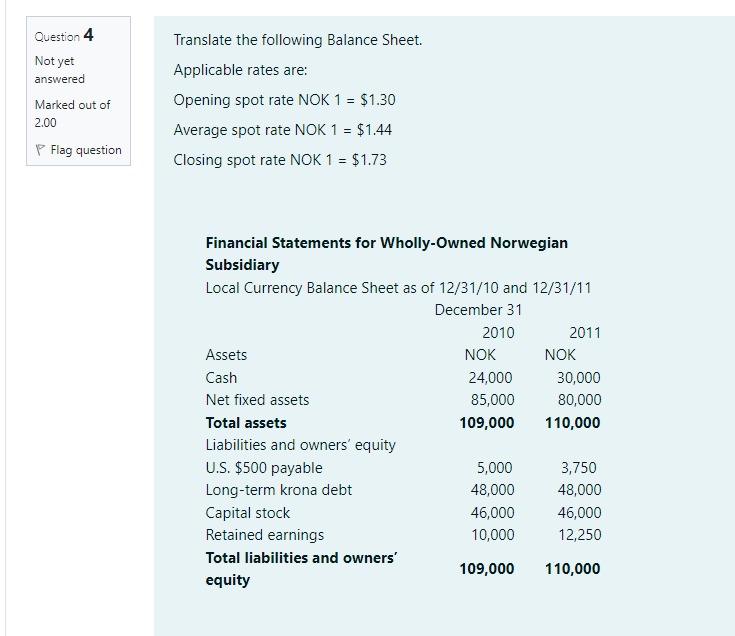

Question: 7 A v B E E E Financial Statements for Wholly-Owned Norwegian Subsidiary Local Currency Balance Sheet as of 12/31/10 and 12/31/11 December 31 2010

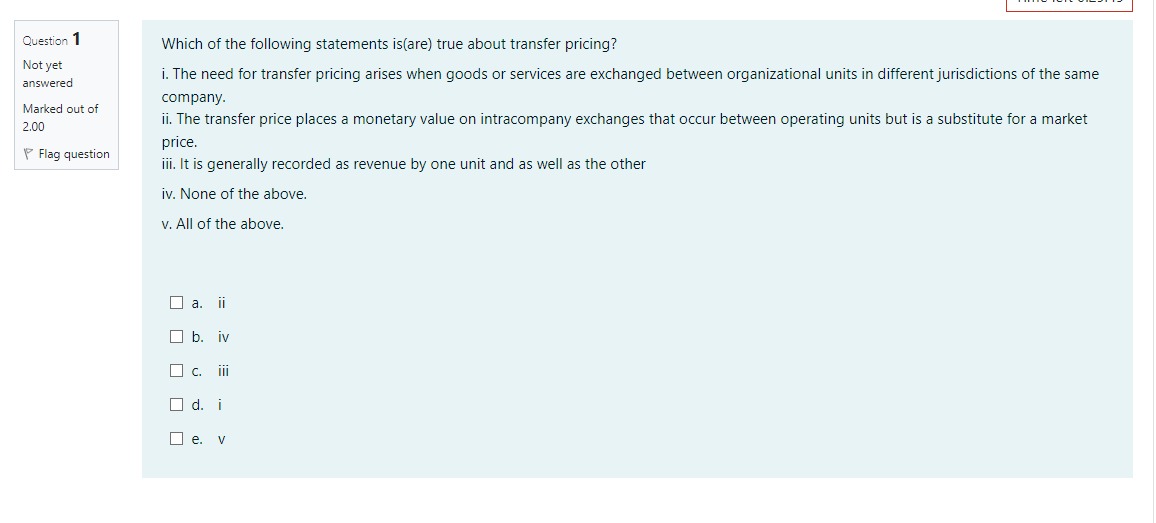

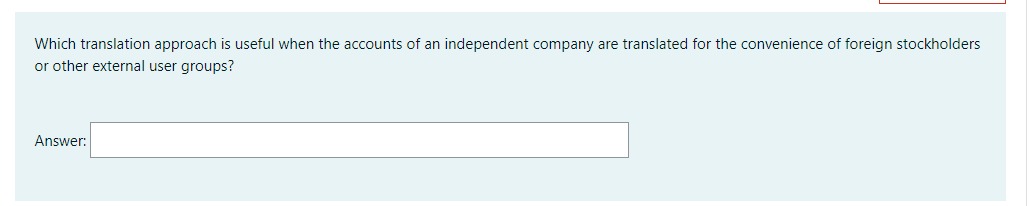

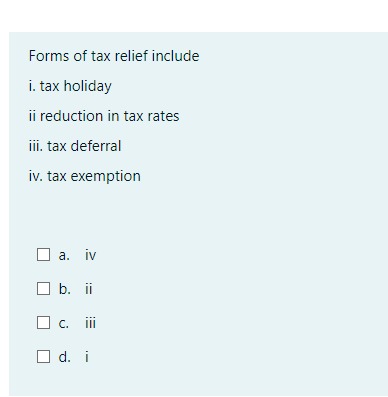

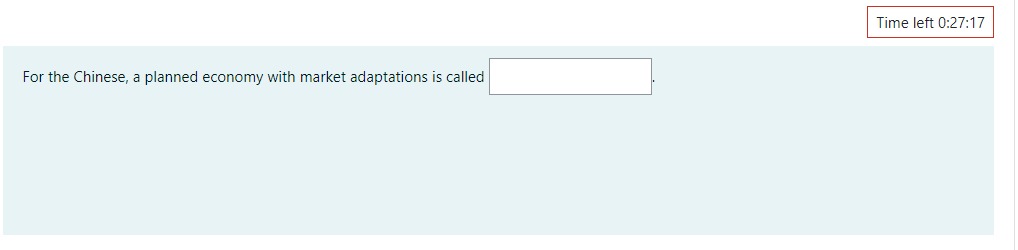

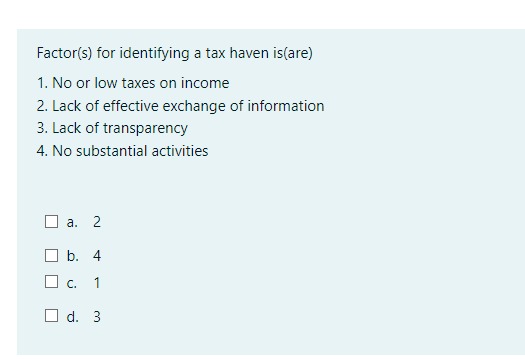

7 A v B E E E Financial Statements for Wholly-Owned Norwegian Subsidiary Local Currency Balance Sheet as of 12/31/10 and 12/31/11 December 31 2010 2011 Assets $$$ $$$ Cash Net fixed assets Total assets Liabilities and owners' equity U.S. $500 payable Long-term krona debt Capital stock Retained earnings Translation adjustment Total liabilities and owners' equity\f\fQuestion 1 Not yet answered Marked out of 2.00 Y7 Flag question Which of the following statements is(are) true about transfer pricing? i. The need for transfer pricing arises when goods or senrices are exchanged between organizational units in differentjurisdictions of the same company. ii. The transfer price places a monetary value on intracompany exchanges that occur between operating units but is a substitute for a market price. iii. It is generally recorded as revenue by one unit and as well as the other iv. None of the above. v. All of the above. a. II b. N c. iii d. I e. v Question 4 Translate the following Balance Sheet. Not yet answered Applicable rates are: Marked out of Opening spot rate NOK 1 = $1.30 2.00 Average spot rate NOK 1 = $1.44 Flag question Closing spot rate NOK 1 = $1.73 Financial Statements for Wholly-Owned Norwegian Subsidiary Local Currency Balance Sheet as of 12/31/10 and 12/31/11 December 31 2010 2011 Assets NOK NOK Cash 24,000 30,000 Net fixed assets 85,000 80,000 Total assets 109,000 110,000 Liabilities and owners' equity U.S. $500 payable 5,000 3,750 Long-term krona debt 48,000 48,000 Capital stock 46,000 46,000 Retained earnings 10,000 12,250 Total liabilities and owners' 109,000 110,000 equityTime left 0:29:16 SOX states that audit partners must rotate every seven (7) years whereas IFRS gives the option to rotate either the audit partner or firm every five (5) years. Select one: O True O FalseSOX pressures both management and the auditors into ensuring that the operating environment is one that: I. has minimal conflicts ii. is transparent iii. is reliable iv. produces accurate financials v. fosters independence among all stakeholders Select one or more: a. iv b. i I c. ii Ud. v De. iiiThe US corporate governance act was passed because of corporations such as Enron and WorldCom. Select one: O True O False\fA direct quote is the price of a unit of the domestic currency in terms of the foreign currency. Select one: O True O FalseWhat translation methods best suit the reader's point of view? Answer:\fWhich translation approach is useful when the accounts of an independent company are translated for the convenience of foreign stockholders or other external user groups? Answer:Forms of tax relief include i. tax holiday ii reduction in tax rates iii. tax deferral iv. tax exemption a. IV b. il IC. III Ud. i\fFactor(s) for identifying a tax haven is(are) 1. No or low taxes on income 2. Lack of effective exchange of information 3. Lack of transparency 4. No substantial activities a. 2 b. 4 Ic. 1 O d. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts