Question: 7. All of the following are potential problems using Internal Rate of Return EXCEPT A project will have as many IRR's as it has changes

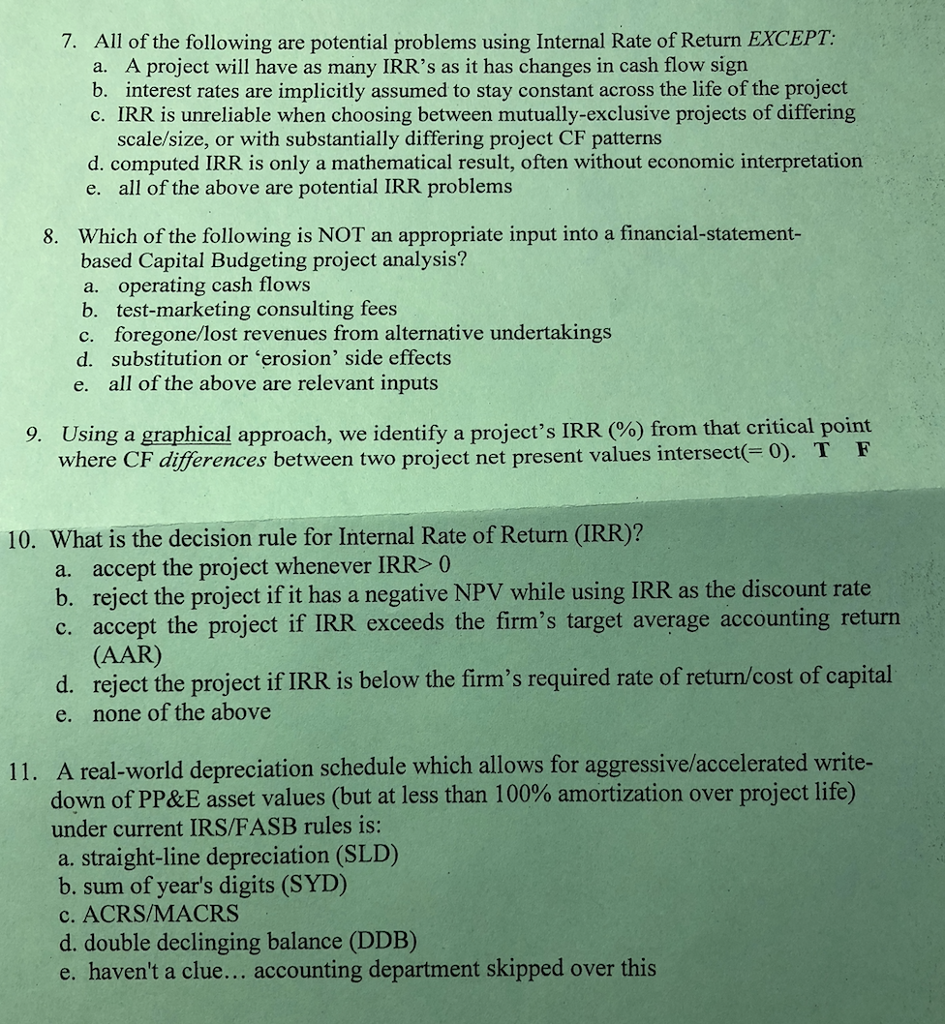

7. All of the following are potential problems using Internal Rate of Return EXCEPT A project will have as many IRR's as it has changes in cash flow sign a. interest rates are implicitly assumed to stay constant across the life of the project c. IRR is unreliable when choosing between mutually-exclusive projects of differing scale/size, or with substantially differing project CF patterns d. computed IRR is only a mathematical result, often without economic interpretation e. all of the above are potential IRR problems Which of the following is NOT an appropriate input into a financial-statement- based Capital Budgeting project analysis? a. operating cash flows b. test-marketing consulting fees c. foregone/lost revenues from alternative undertakings d. substitution or 'erosion' side effects e. all of the above are relevant inputs 8. Using a graphical approach, we identify a project's IRR (%) from that critical point where CF differences between two project net present values intersect( 0 9. s between two project net present values intersect( 0). T F 10. What is the decision rule for Internal Rate of Return (IRR)? a. accept the project whenever IRR 0 b. reject the project if it has a negative NPV while using IRR as the discount rate c. accept the project if IRR exceeds the firm's target average accounting return (AAR) d. reject the project if IRR is below the firm's required rate of return/cost of capital e. none of the above A real-world depreciation schedule which allows for aggressive/accelerated write- down of PP&E asset values (but at less than 100% amortization over project life) under current IRS/FASB rules is a. straight-line depreciation (SLD) b. sum of year's digits (SYD) c. ACRS/MACRS d. double declinging balance (DDB) e. haven't a clue... accounting department skipped over this 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts