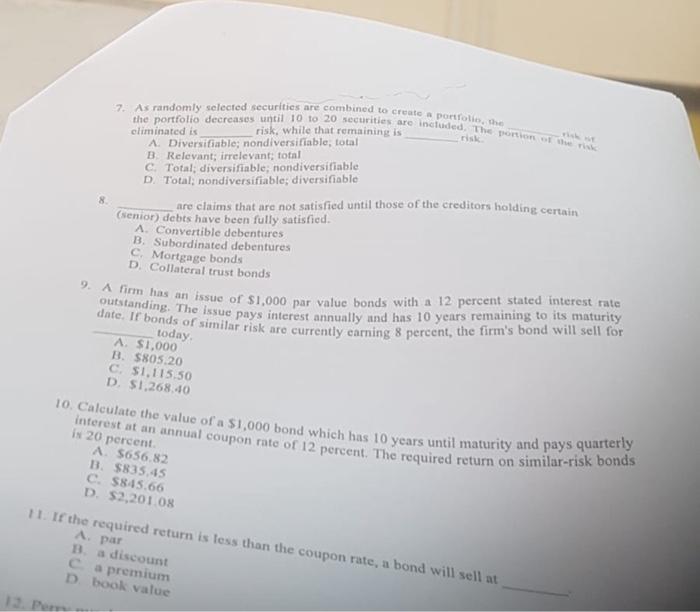

Question: 7. As randomly selected securities are combined to create a portrolio, Dhe the portfolio climinated is risk. while that remaining is ristes A. Diversifiable; nondiversifiable;

7. As randomly selected securities are combined to create a portrolio, Dhe the portfolio climinated is risk. while that remaining is ristes A. Diversifiable; nondiversifiable; total B. Relevant; irrelevant: tofal C. Total; diversifiable; nondiversifiable D. Total; nondiversifiable; diversifiable 8. are claims that are not satisfied until those of the creditors holding certain (senior) debts have been fully satisfied. A. Convertible debentures B. Subordinated debentures. C. Mortgage bonds D. Collateral trust bonds 9. A firm has an issue of $1,000 par value bonds with a 12 percent stated interest rate outstanding. The issue pays interest annually and has 10 years remaining to its maturity date, If bonds of similar risk are currently earning 8 percent, the firm's bond will sell for today. A. $1,000 B. $805.20 C. $1,115.50 D. $1,268,40 10. Calculate the value of a $1,000 bond which has 10 years until maturity and pays quarterly inferest at an annual coupon rate of 12 percent. The required return on similar-risk bonds A. 5656.82 B. $835,45 C. \$8.45.66 D. 52,201.08 A. Par B. a discount C a premium D book vatue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts