Question: = 7. At time t = 0 you put 100 into a deposit account for 6 months with continuously compounded rate r = 12%. If

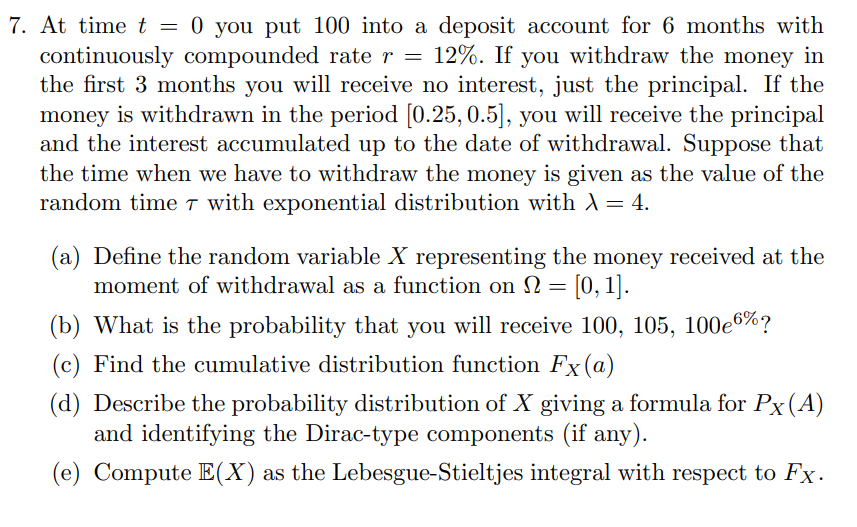

= 7. At time t = 0 you put 100 into a deposit account for 6 months with continuously compounded rate r = 12%. If you withdraw the money in the first 3 months you will receive no interest, just the principal. If the money is withdrawn in the period (0.25, 0.5), you will receive the principal and the interest accumulated up to the date of withdrawal. Suppose that the time when we have to withdraw the money is given as the value of the random time t with exponential distribution with l = 4. (a) Define the random variable X representing the money received at the moment of withdrawal as a function on N = [0, 1]. (b) What is the probability that you will receive 100, 105, 100e6%? (c) Find the cumulative distribution function Fx(a) (d) Describe the probability distribution of X giving a formula for Px(A) and identifying the Dirac-type components (if any). (e) Compute E(X) as the Lebesgue-Stieltjes integral with respect to Fx. = 7. At time t = 0 you put 100 into a deposit account for 6 months with continuously compounded rate r = 12%. If you withdraw the money in the first 3 months you will receive no interest, just the principal. If the money is withdrawn in the period (0.25, 0.5), you will receive the principal and the interest accumulated up to the date of withdrawal. Suppose that the time when we have to withdraw the money is given as the value of the random time t with exponential distribution with l = 4. (a) Define the random variable X representing the money received at the moment of withdrawal as a function on N = [0, 1]. (b) What is the probability that you will receive 100, 105, 100e6%? (c) Find the cumulative distribution function Fx(a) (d) Describe the probability distribution of X giving a formula for Px(A) and identifying the Dirac-type components (if any). (e) Compute E(X) as the Lebesgue-Stieltjes integral with respect to Fx

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts