Question: 7. (Ch. 8) Forecasting the Future Spot Rate Based on IFE. Assume that the spot exchange rate of the South African rand (ZAR) is USD

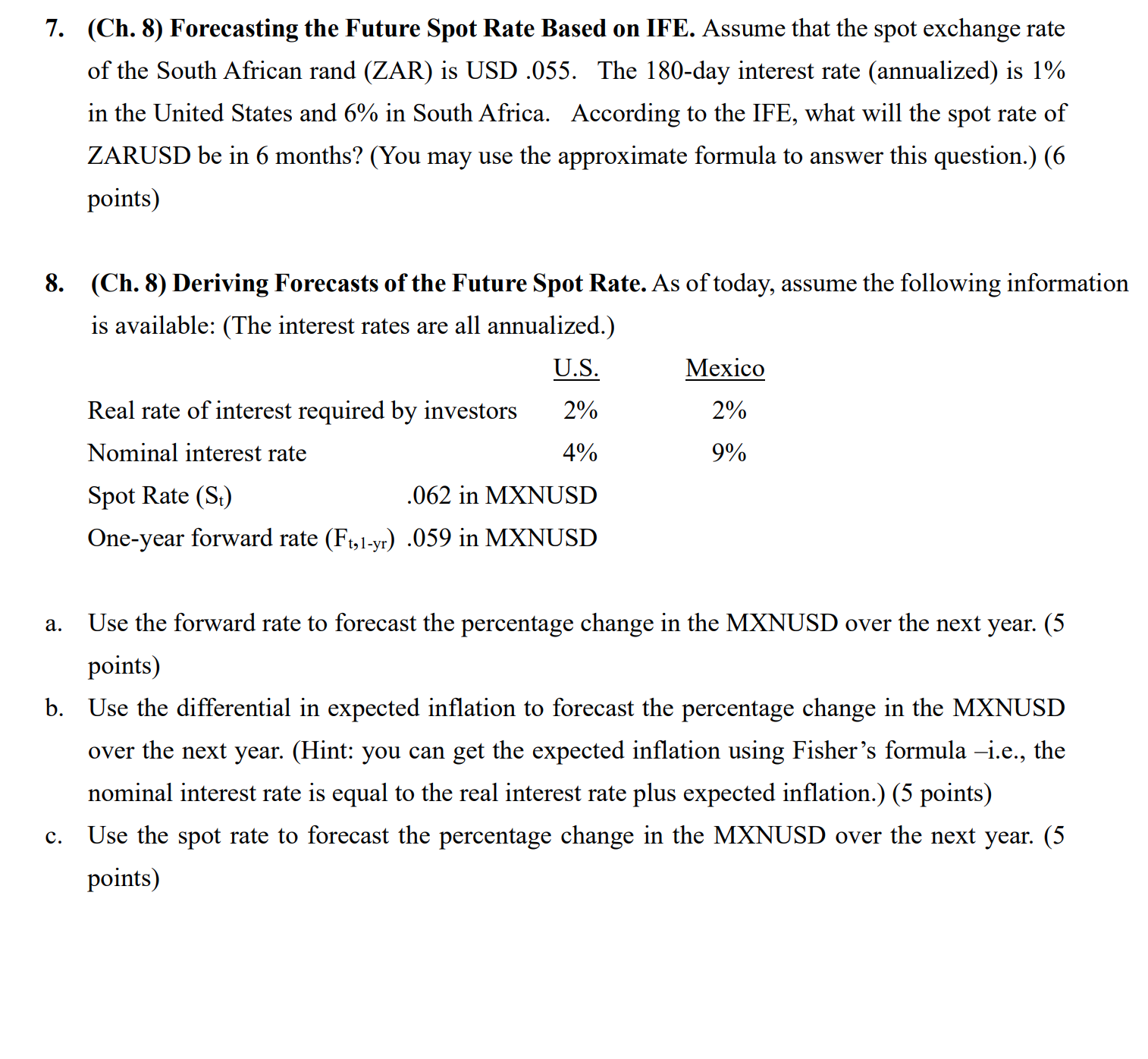

7. (Ch. 8) Forecasting the Future Spot Rate Based on IFE. Assume that the spot exchange rate of the South African rand (ZAR) is USD .055. The 180-day interest rate (annualized) is 1% in the United States and 6\% in South Africa. According to the IFE, what will the spot rate of ZARUSD be in 6 months? (You may use the approximate formula to answer this question.) (6 points) 8. (Ch. 8) Deriving Forecasts of the Future Spot Rate. As of today, assume the following informatic is available: (The interest rates are all annualized.) a. Use the forward rate to forecast the percentage change in the MXNUSD over the next year. (5 points) b. Use the differential in expected inflation to forecast the percentage change in the MXNUSD over the next year. (Hint: you can get the expected inflation using Fisher's formula - i.e., the nominal interest rate is equal to the real interest rate plus expected inflation.) (5 points) c. Use the spot rate to forecast the percentage change in the MXNUSD over the next year. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts