Question: # 7 - chapter 1 2 - 1 Question 3 of 4 5 . 0 9 1 0 , - = , ! Current Attempt

# chapter

Question of

Current Attempt in Progress

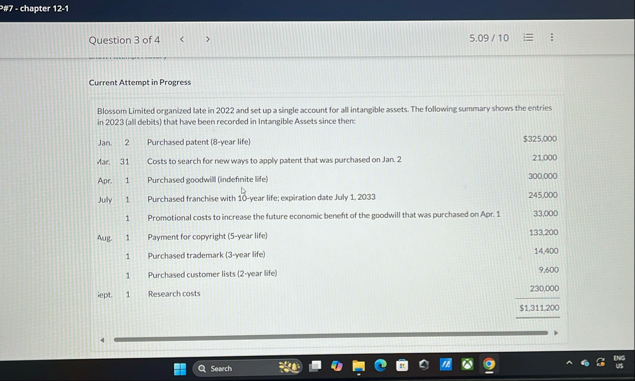

Blossom Limited organized late in and set up a single account for all intargible assets. The following summary shows the entries in all debits that have been recorded in Intangible Assets since then

tableJanPurchased patent year life$MarCosts to search for new ways to apply patent that was purchased on Jan. AprPurchased goodwill indefinite IffeJulyPurchased franchlse with year life; expiration date July Promotional costs to increase the future economic benefit of the goodwill that was purchased on Apr. AugPayment for copyright year lifePurchased trademark yearlife,Purchased customer lists year lifeieptResearch costs,$

Search chapter

Question of

Prepare the necessary entry to clear the Intangible Assets account and to set up separate accounts for distinct types of intangibles. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries

tableAccount Titles and Explanation,Debit,CreditIntangible AssetsPatents,GoodwillIntangible AssetsFranchises,,Intangible AssetsCogrrights,Accumulated Amortization Copyrights,,Intangible AssetsCustomer lists,,Question of

Your answer is partially correct.

Make the entry as at December for any necessary amortization so that all balances are accurate as at that date. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to decimal places, es If no entry is required, select No Entry" for the account titles and enter for the omounts. Ust oll debit entries before credit entries

Account Titles and Explanation

Debit

Credit

Annortization Expense

Accumulated Amortization Patents

Accumulated Amortication Paterts

Accumulated Amortization Franchises

Accumulated Amortization Copyrights

Accumulated Amortization Trademarks

Accumulated Amortization Customer lists

eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock