Question: 7. Chapter MC, Section .02, Problem 075 Edwards Electronics recently reported $11,250 of sales, $5,500 of operating costs other than depreciation, and $1,250 of

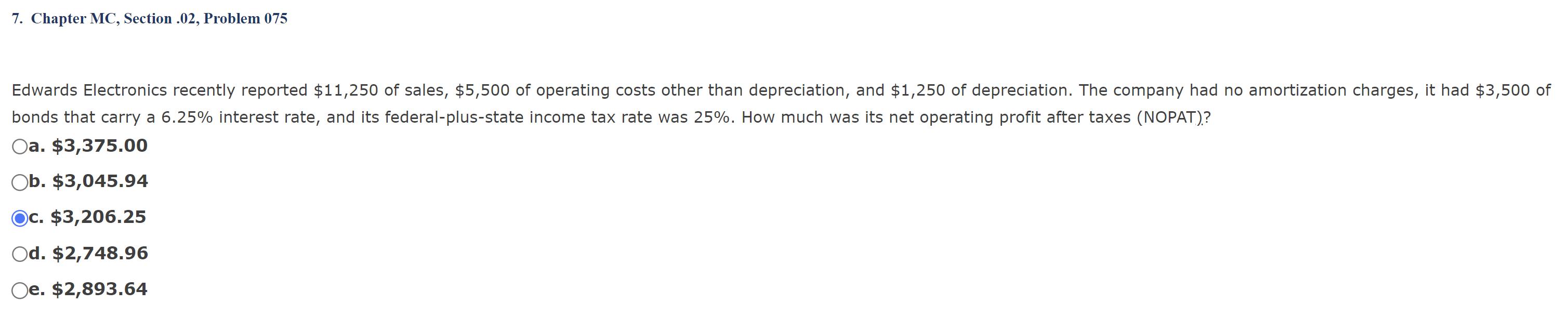

7. Chapter MC, Section .02, Problem 075 Edwards Electronics recently reported $11,250 of sales, $5,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges, it had $3,500 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 25%. How much was its net operating profit after taxes (NOPAT)? Oa. $3,375.00 Ob. $3,045.94 Oc. $3,206.25 Od. $2,748.96 Oe. $2,893.64

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

NOPAT Oper... View full answer

Get step-by-step solutions from verified subject matter experts