Question: 7 ) Compute the TOTAL VARIABLE COSTS PER UNII for each of the products ( tents , jackets, and boots ) , based on standard

Compute the TOTAL VARIABLE COSTS PER UNII for each of the products tents jackets, and boots based on standard costs, and compute the TOTAL FDCED COST for the company. Then, discuss how the variable costs and fixed costs would change if the company decided to ELIMINATE THE JACKETS PRODUCT LINE. points

Based on the most recent selling prices, compute the CONIRIBUTIONMARGINPER UNI for each of the products tents jackets, and boots points

c Gupt and Downen,

Compute the BREAKEVEN POINI assuming that the company decided to produce and sell only the tents product line. Then, compute the BREAKEVENPOINI assuming that the company decided to continue with tents and boots but to discontinue jackets and assuming that the company can usually sell two units of tents for every unit of jackets points

Compute the BREAKEVENPOINI and the TARGET PROFIT VOLUME assuming that the company decided to continue operating all three product lines and assuming that the company can usually sell four units of tents for every two units of jackets and for every two pairs of boots points

Given the potential increase in competition, what could the company do to be more profitable? What actions might the company take to better control costs? points

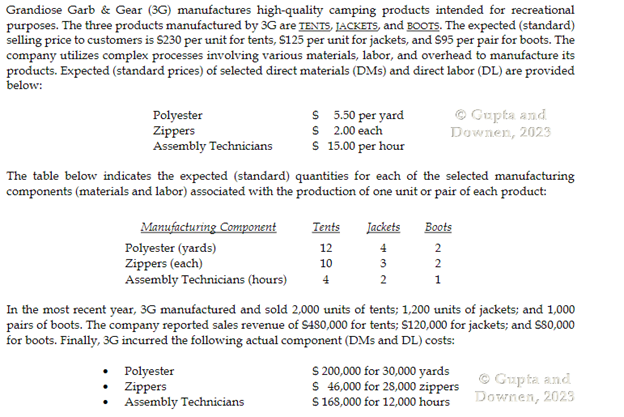

Grandiose Garb & Gear G manufactures highquality camping products intended for recreational

purposes. The three products manufactured by G are IENTS, IACKETS, and BOOTS. The expected standard

selling price to customers is $ per unit for tents, $ per unit for jackets, and $ per pair for boots. The

company utilizes complex processes involving various materials, labor, and overhead to manufacture its

products. Expected standard prices of selected direct materials DMs and direct labor DL are provided

below:

The table below indicates the expected standard quantities for each of the selected manufacturing

components materials and labor associated with the production of one unit or pair of each product:

In the most recent year, G manufactured and sold units of tents; units of jackets; and

pairs of boots. The company reported sales revenue of $ for tents; $ for jackets; and $

for boots. Finally, G incurred the following actual component DMs and DL costs:

Polyester

Zippers

$ for yards

Assembly Technicians

S for zippers

c Gupta and

$$ for hours

Downen,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock