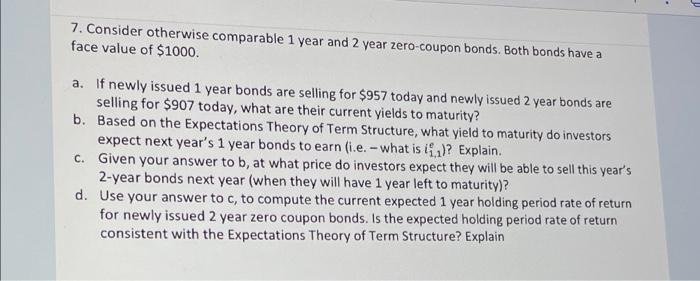

Question: . 7. Consider otherwise comparable 1 year and 2 year zero-coupon bonds. Both bonds have a face value of $1000. a. If newly issued 1

. 7. Consider otherwise comparable 1 year and 2 year zero-coupon bonds. Both bonds have a face value of $1000. a. If newly issued 1 year bonds are selling for $957 today and newly issued 2 year bonds are selling for $907 today, what are their current yields to maturity? b. Based on the Expectations Theory of Term Structure, what yield to maturity do investors expect next year's 1 year bonds to earn (i.e. - what is i..)? Explain. C. Given your answer to b, at what price do investors expect they will be able to sell this year's 2-year bonds next year (when they will have 1 year left to maturity)? d. Use your answer to c, to compute the current expected 1 year holding period rate of return for newly issued 2 year zero coupon bonds. Is the expected holding period rate of return consistent with the Expectations Theory of Term Structure? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts