Question: 7. Consider Table 2 above and projects 1, 2, 3, and 4. Assume that the discount rate is 10% for each project. The ranking each

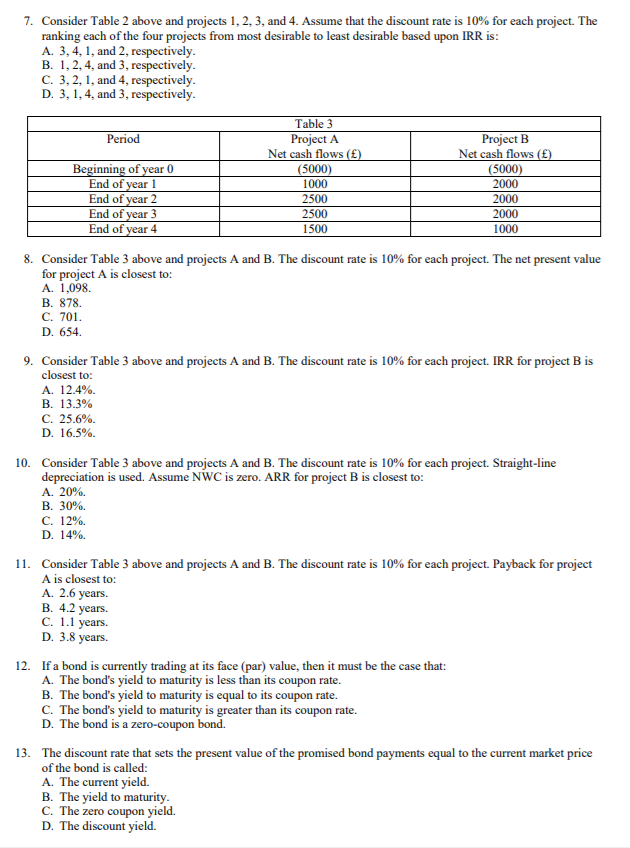

7. Consider Table 2 above and projects 1, 2, 3, and 4. Assume that the discount rate is 10% for each project. The ranking each of the four projects from most desirable to least desirable based upon IRR is: A. 3, 4, 1, and 2, respectively. B. 1, 2, 4, and 3, respectively. C. 3, 2, 1, and 4, respectively. D. 3, 1, 4, and 3, respectively. Period Beginning of year 0 End of year 1 End of year 2 End of End of year 4 Table 3 Project A Net cash flows () (5000) 1000 2500 2500 1500 Project B Net cash flows () (5000) 2000 2000 2000 1000 year 3 8. Consider Table 3 above and projects A and B. The discount rate is 10% for each project. The net present value for project A is closest to: A. 1,098 B. 878. C. 701. D. 654. 9. Consider Table 3 above and projects A and B. The discount rate is 10% for each project. IRR for project B is closest to: A. 12.4% B. 13.3% C. 25.6%. D. 16.5%. 10. Consider Table 3 above and projects A and B. The discount rate is 10% for each project. Straight-line depreciation is used. Assume NWC is zero. ARR for project B is closest to: A. 20% B. 30%. C. 12%. D. 14%. 11. Consider Table 3 above and projects A and B. The discount rate is 10% for each project. Payback for project A is closest to: A. 2.6 years. B. 4.2 years. C. 1.1 years. D. 3.8 years. 12. If a bond is currently trading at its face (par) value, then it must be the case that: A. The bond's yield to maturity is less than its coupon rate. B. The bond's yield to maturity is equal to its coupon rate. C. The bond's yield to maturity is greater than its coupon rate. D. The bond is a zero-coupon bond. 13. The discount rate that sets the present value of the promised bond payments equal to the current market price of the bond is called: A. The current yield. B. The yield to maturity. C. The zero coupon yield. D. The discount yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts