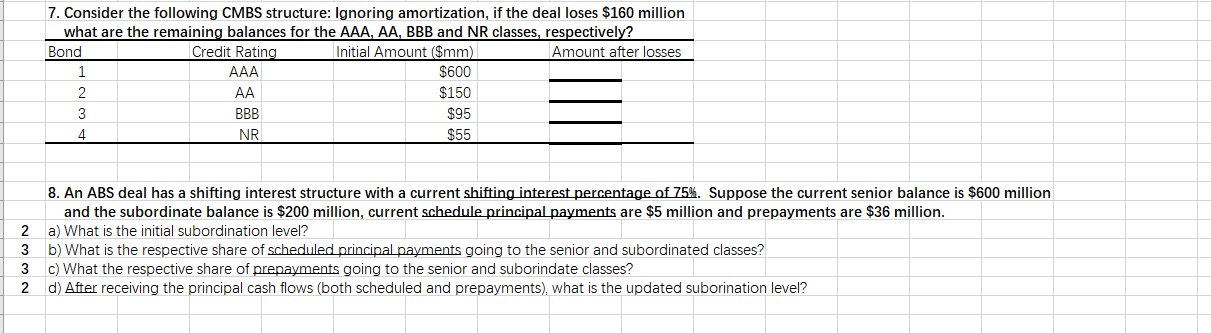

Question: 7. Consider the following CMBS structure: Ignoring amortization, if the deal loses $160 million what are the remaining balances for the AAA, AA, BBB and

7. Consider the following CMBS structure: Ignoring amortization, if the deal loses $160 million what are the remaining balances for the AAA, AA, BBB and NR classes, respectively? Bond Credit Rating Initial Amount ($mm) Amount after losses AAA $600 AA $150 BBB $95 NR $55 2 3 3 2 8. An ABS deal has a shifting interest structure with a current shifting interest percentage of 75%. Suppose the current senior balance is $600 million and the subordinate balance is $200 million, current schedule principal payments are $5 million and prepayments are $36 million. a) What is the initial subordination level? b) What is the respective share of scheduled principal payments going to the senior and subordinated classes? c) What the respective share of prepayments going to the senior and suborindate classes? d) After receiving the principal cash flows (both scheduled and prepayments), what is the updated suborination level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts